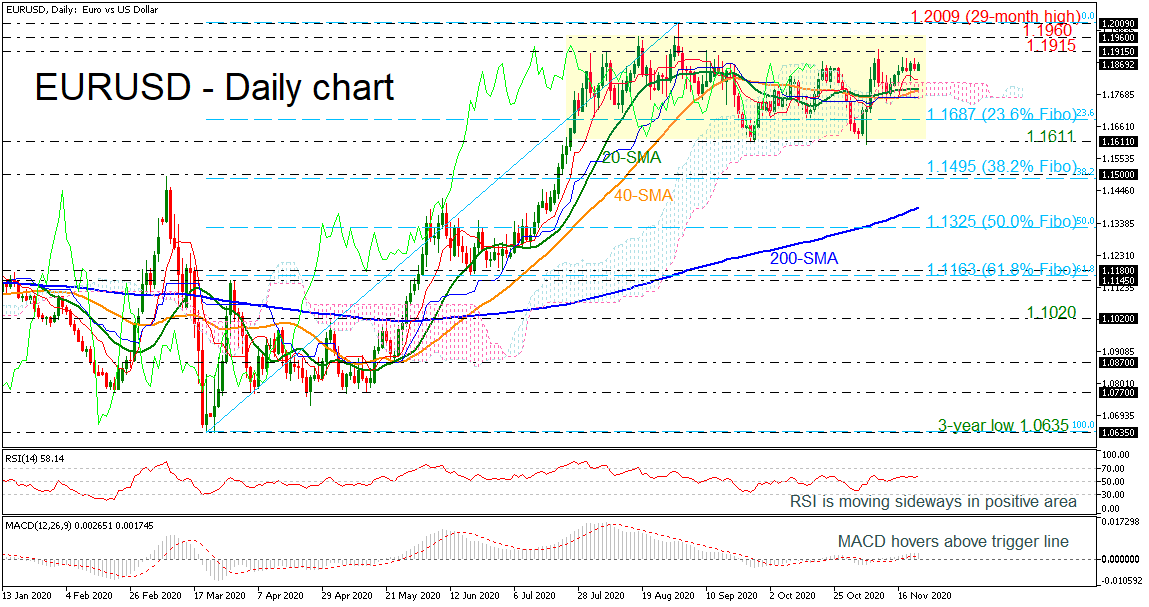

Technical Analysis – EURUSD consolidates around 1.1900; indicators are flat

According to the technical indicators, the RSI is moving sideways in the positive area and the MACD is standing above its trigger and zero lines with weak momentum.

Immediate resistance could come from the 1.1915 barrier, tested several times in the past. Driving the market higher, the 1.1960 hurdle could attract traders’ attention before hitting the 29-month high of 1.2009 and penetrating the trading range to the upside. Above this line, the neutral outlook could turn to bullish.

Alternatively, a downside movement beneath the SMAs and the cloud could send the price towards the 23.6% Fibonacci retracement level of the up leg from 1.0635 to 1.2009 at 1.1687. Slightly below this level, 1.1611 is coming next ahead of a downside reversal until the 38.2% Fibonacci of 1.1495.

Concluding, EURUSD has not yet been able to improve its long-term bullish structure and only a jump above the 1.2009 obstacle could endorse the outlook back to positive.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.