If You Don’t Have Any Time This Morning

Incoming data still reflects the push-pull dynamics of the shutdown and reopening; we don’t have a clear picture of the growth trajectory after those dynamics play out. Fiscal policy in the U.S. is a mess.

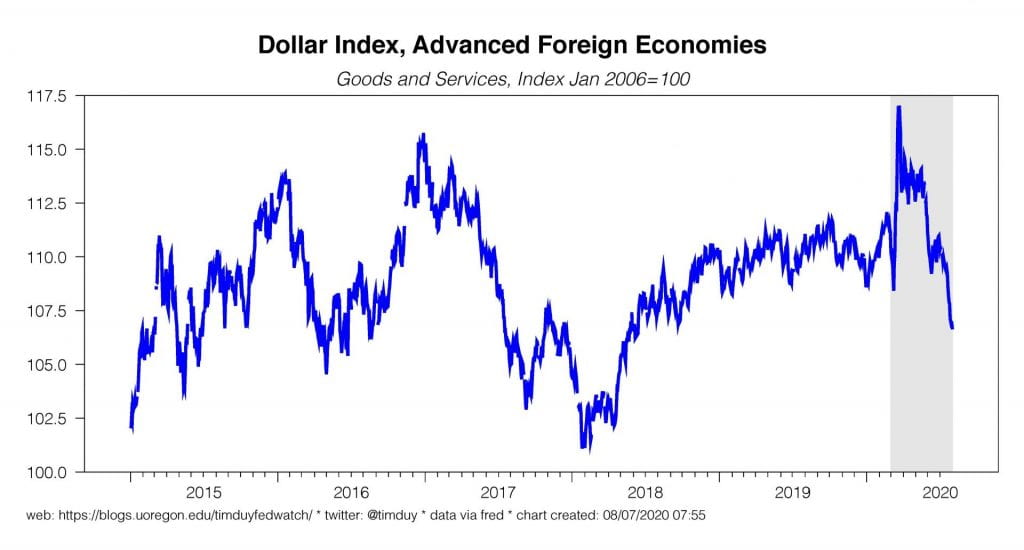

The Dollar

I noticed this via Reuters:

The dollar is at its most oversold level in over 40 years, investment bank Morgan Stanley said on Friday, adding it had now shifted from its dollar-bearish stance and turned “tactically neutral” on the U.S. currency.

I want to make clear that there are two separate dollar stories circulating. One story is that the dollar is less attractive due to anticipated growth differentials between the U.S. and other nations, particularly Europe. Perfectly reasonable but note that that story can take on a life of its own until the dollar is oversold; Morgan Stanley apparently believes we have reached that point, at least in the near term. The fiscal follies in the U.S. hint that maybe this bet has more room to run, but be wary that Democrats and Republicans eventually reach a deal.

The second story is that you should sell the dollar because it is about to lose its status as a reserve currency. All I am going to say on that point is that I have heard a version of that story every few years since I was in grade school (don’t ask how exactly how long; long enough) and yet the dollar seems to only grow in importance. Recall that just a few months ago, there was a dollar shortage that required the Fed to open up swap lines with global central banks.

I would suggest leveraging your dollar negative bets, should you be inclined, on the first narrative rather than the second.

Key Data

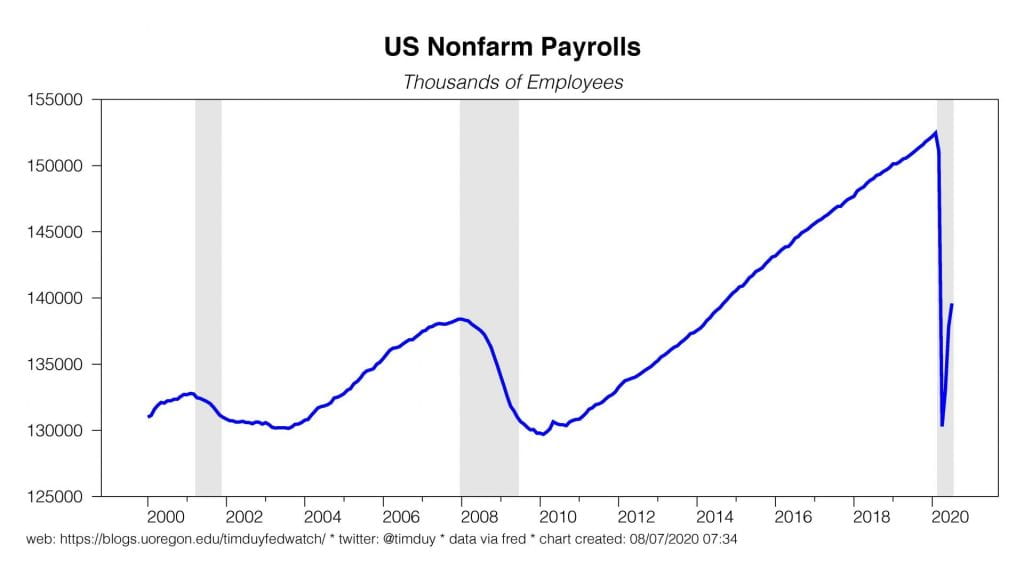

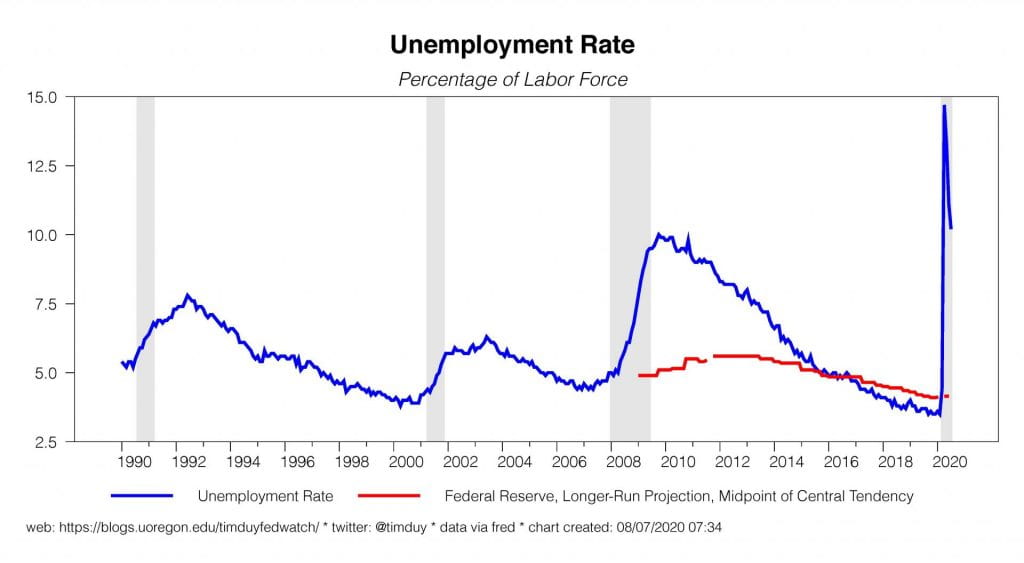

The highlight of the week was the employment report. The U.S. economy added 1.8 million jobs in July, a surprisingly strong number given still high initial unemployment claims, weak ADP report earlier in the week (a gain of only 167k private sector jobs), and Census Pulse data that suggested a downturn in the jobs market. The combination is somewhat puzzling. I suspect the establishment report is still being push and pulled by the dynamics of the sudden shutdown and the initial reopening and has yet to reveal where the labor market stands after those dynamics have played out. The other data I think is signaling that we are close to seeing that process conclude and will soon settle into a slow grow trajectory.

The headline unemployment rate fell from 10.9% to 10.2% while the broader U-6 measure of unemployment declined more sharply, falling to 16.5% from 18.0% in June. On the other hand, workers are not streaming back into the labor market yet. Labor force participation edged down 0.1 percentage points to 61.4%, 2 percentage points lower than prior to the pandemic, a decline that helps hold down the unemployment rate. Watch of course how this number evolves going forward. Now that the enhanced unemployment benefits have expired, some persons currently not in the labor force may reenter (of course it is not clear that there are jobs available for them). Also, widespread school closures and childcare issues may pull some working parents from the labor market or prevent them from returning. Meanwhile, initial unemployment claims fell to 1.186 million in the final week of July while continuing claims maintained their slow decline.

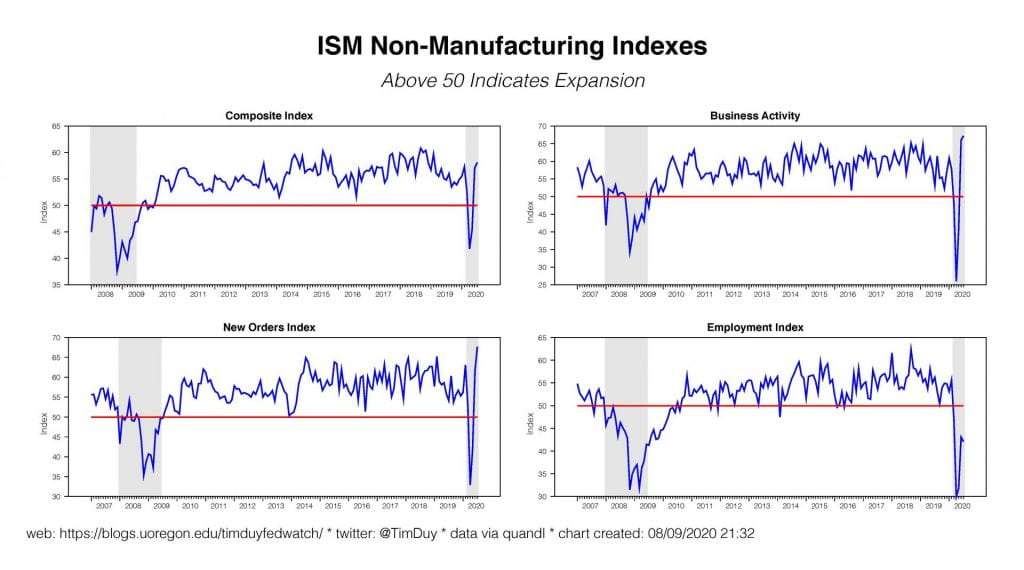

Early in the week, the Institute of Supply Management release solid reports for both manufacturing and the services sector of the economy. Note though that the data is bouncing off the bottom, and a diffusion index like these should get a solid pop when the economy goes from “closed” to “mostly open.” Also note that the improvement in most components has not yet translated into similar gains in the employment component . This again suggests a weak employment picture after the start-stop dynamics end.

Federal Reserve officials reiterated some common these last week. Dallas Federal Reserve President Robert Kaplan said increasing Covid-19 infections are weighing on the recovery and more fiscal support is critical. Cleveland Federal Reserve President Loretta Mester echoed these themes. Federal Reserve Vice Chair Richard Clarida was fairly optimistic in a CNBC interview:

“It will take some time I believe before we get back to the level of activity we were at in February before the pandemic hit,” he said. “My baseline view is that we could get back to the level of activity perhaps towards the end of 2021. There are a lot of moving parts with the virus and the global outlook.”

That said, his forecast was dependent on the current stalled fiscal support talks and, curiously, the view that the U.S. economy has suffered little permanent damage. The still high level of initial unemployment claims, however, suggests otherwise.

Boston Federal Reserve President Eric Rosengren attempted to defend the struggling Main Street Lending Program at a Congressional Oversight Panel. The program has seen limited use although Rosengren expects interest to rise if the economy worsens. I find this somewhat distressing as it suggests the Fed no longer hopes the program will accelerate the recovery and instead is only a backstop in case the economy slides further. That said, I never really had high hopes for the program in the first place. Fundamentally, to survive this crisis and thrive on the other side, many firms need grants not loans. A useful alternative would be zero rate long term loans with weak underwriting conditions that expected a high rate of business failures. But loans that just saddle a firm with additional debt that they will struggle to repay in the future are just simply not that attractive.

Upcoming Data

A fun week ahead. It starts off a bit slow with JOLTS for June (more of a data nerd report, so I like it but I am not convinced it is a market mover) on Monday and PPI on Tuesday. Thursday is the usual initial claims data. Friday it gets more interesting. We get retail sales for July; expectations are the core sales continue to improve and rise 1.6% over the previous month. But how much value is this data now that enhanced unemployment benefits have ended? Industrial production is expected to gain 3.0% in July over June. Productivity growth for Q2 is expected to come in at 1.5%. We also get preliminary Michigan sentiment numbers, expected to ease to 72.0 in August from 72.5 in July. For the most part, the data flow for July will likely reveal the impact of the rebound from the initial shutdowns; probably more important is the August data in which we will have a better sense of the likely growth trajectory going forward.

Fiscal Policy Update

Talks between Democrats and Republicans broke down last week leaving the economy adrift without the substantial fiscal support that has kept the lights on for many households. President Donald Trump responded with a series of executive orders intended to force through additional support by decree and force Democrats back to the table. It is not clear, however, that the orders will provide much support for the economy. I think the best bet is that they will provide little benefit anytime soon.

One order directs $44 billion of disaster relief funds to federal unemployment benefits, providing an additional $300 per week compared to the existing $600. It is not yet clear when or if these benefits will ever see the light of day (see Jack Balkin here). To utilize the benefits, states need to contribute another $100 per week of benefits; given that states were already struggling with a revenue downturn, it is not clear when or if they will be able to support the match. In addition, the order includes a cutoff that limits the additional benefits for those earning $100 a week or more from regular UI benefits. In large part, states lack the capacity to fine tune unemployment benefits in such a way and may opt out knowing that the money might be gone by the time they remake their systems. It thus seems unlikely that this money would arrive anytime soon and even if it did it only provides benefits for roughly six weeks.

A second order defers payment of the worker portion of the payroll tax from September 1 to December 31. “Defers” is just what it sounds like; the tax will still be owed next year. Trump promised to create tax relief if re-elected, but of course can’t do that unilaterally. So for the moment firms are caught in legal limbo. Do they stop collecting the tax from workers knowing that they could be liable for the tax at some point in the future? I would think that most firms continue to collect the tax. Moreover, it is not particularly effective stimulus as it does nothing to address the problem of people without jobs. Finally, it opens up a nasty political problem because the payroll tax funds Social Security and Medicare (notice I said political problem; it’s just an accounting issue at a certain level).

A third order claims to extend the eviction moratorium, but doesn’t really and directs agencies to fund funds or find other mechanisms to help prevent foreclosures, if possible. A fourth order continues the zero-interest rate interruption of student loan payments until the crisis is over. This probably isn’t legal but it is not evident who would challenge the order

It thus seems like these orders are a lot of smoke but not much fire. The only potentially meaningful part, the extension of unemployment benefits, has a limited lifespan and may never really get off the ground, certainly not in a timely fashion. For the moment at least we need to recognize that the economy has lost a key part of support and still faces a dire need for state and local aid.

Bottom Line: The U.S. economy continues to bounce off the bottom; we don’t have a good sense of the ultimate growth trajectory. The fiscal setback is a red flag for the economy; the Fed can’t compensate entirely if the Federal government pulls back from supporting the economy. At this point, the U.S. looks positioned to repeat the fiscal mistakes of the last recovery.