-

China GDP: economy avoids recession with second-quarter growth of 3.2 per cent amid coronavirus recovery

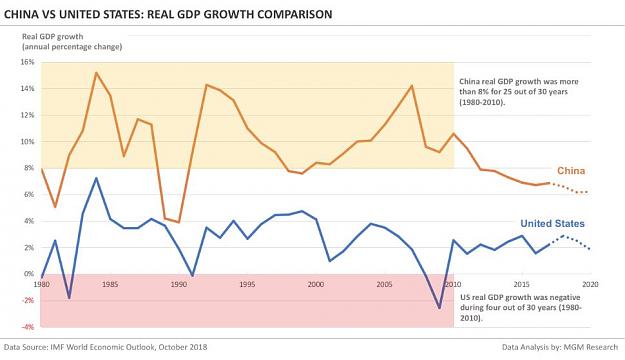

China avoided a recession after its economy grew by 3.2 per cent in the second quarter of 2020, indicating a recovery from the damage caused by the coronavirus pandemic. The world’s second largest economy had shrank by 6.8 per cent in the first three months of the year, the first contraction since the end of the Cultural Revolution in 1976. The median forecast of analysts polled by Bloomberg had predicted growth of 2.4 per cent in the second quarter. A technical recession is defined as two consecutive quarters of contraction in gross domestic product. chart The data confirmed that China will be probably the first ... (full story)

-

China's Economy Returns To Growth In Q2 But Retail Sales Continue To Contract

Judging by the Chinese stock market, Chinese credit impulse data, and Chinese PMIs, tonight's GDP data should be a big winning rebound proving the communist nation has overcome the viral enemy and is back on its path to global economic domination. chart The "v-shaped" recovery in all the PMIs is rather impressively well managed... chart And Total Social Financing is soaring at a record pace... chart And while trade data rebounded surprisingly in June (as it stepped up efforts to meet the terms of the U.S. trade deal), it remains well down from 2019 in the first six months of 2020, but rebounds are expected ... (full story)

- Comments

- Comment

- Subscribe

- Comment #1

- Quote

- Jul 15, 2020 10:19pm Jul 15, 2020 10:19pm

-

kingleeny

kingleeny - Joined Jul 2014 | Status: Member | 1479 Comments

- Comment #2

- Quote

- Jul 16, 2020 12:41am Jul 16, 2020 12:41am

- Guest

- | IP XX.XXX.95.37

- Comment #3

- Quote

- Jul 16, 2020 12:46am Jul 16, 2020 12:46am

- aboongm

- | Joined Jun 2020 | Status: Junior Member | 4 Comments

- Comment #4

- Quote

- Jul 16, 2020 6:34am Jul 16, 2020 6:34am

- JustBreathe

- | Joined Dec 2019 | Status: Member | 141 Comments

- Comment #5

- Quote

- Jul 16, 2020 7:27am Jul 16, 2020 7:27am

- Guest

- | IP XXX.XX.222.203

- Comment #6

- Quote

- Jul 16, 2020 7:45am Jul 16, 2020 7:45am

-

Lamplighter

Lamplighter - | Joined Sep 2017 | Status: Member | 1006 Comments

- Comment #7

- Quote

- Jul 16, 2020 8:06am Jul 16, 2020 8:06am

-

fxx360

fxx360 - | Joined Dec 2011 | Status: Member | 926 Comments