If You Don’t Have Any Time This Morning

Surging Covid-19 cases reveal the fragility of the recovery. Still, the regional nature of the cases offers the possibility of avoiding a widespread shutdown like that of earlier this year. In such a case, the recover would remain slow, but would continue.

Key Data

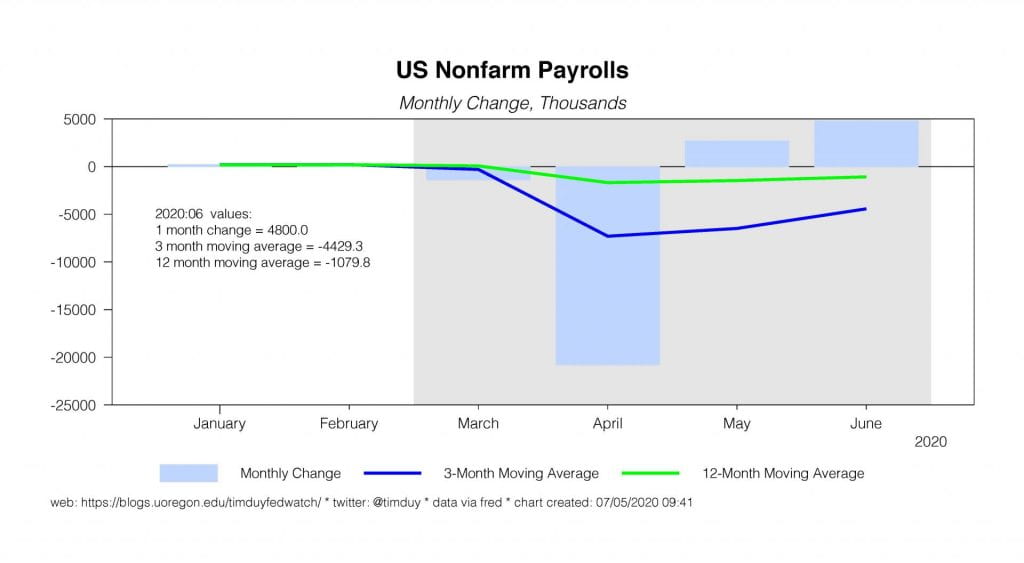

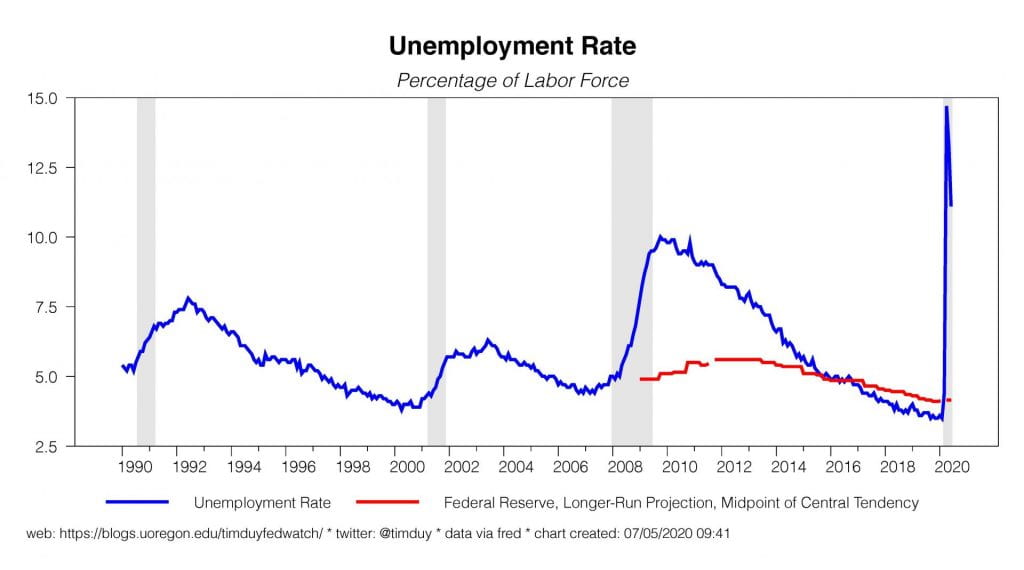

It was widely anticipated that the jobs market would extend its May gains and the employment report did not disappoint. Employment rose 4.8 million in June while May was revised slightly higher to a 2.7 million gain; the unemployment rate fell from 13.3% to 11.1%. Wall Street embraced the report with market participants pushing the S&P500 0.45% higher.

On the surface, this was a good report in that it revealed an economy behaving largely as expected. Many jobs should come back quickly once lock-down restrictions eased. Economic conditions are improving, and it shouldn’t be a surprise that markets are reacting to that improvement.

That said, even a good report needs to be placed in context. Notably, the job gains to date are only a fraction of the 22.2 million jobs lost in March and April. In addition, while the broader U-6 unemployment rate, which captures measures of underemployment, improved by 3.2 percentage points, it still stands at 18.0%. We still have a long climb ahead of us to return to pre-Covid employment levels.

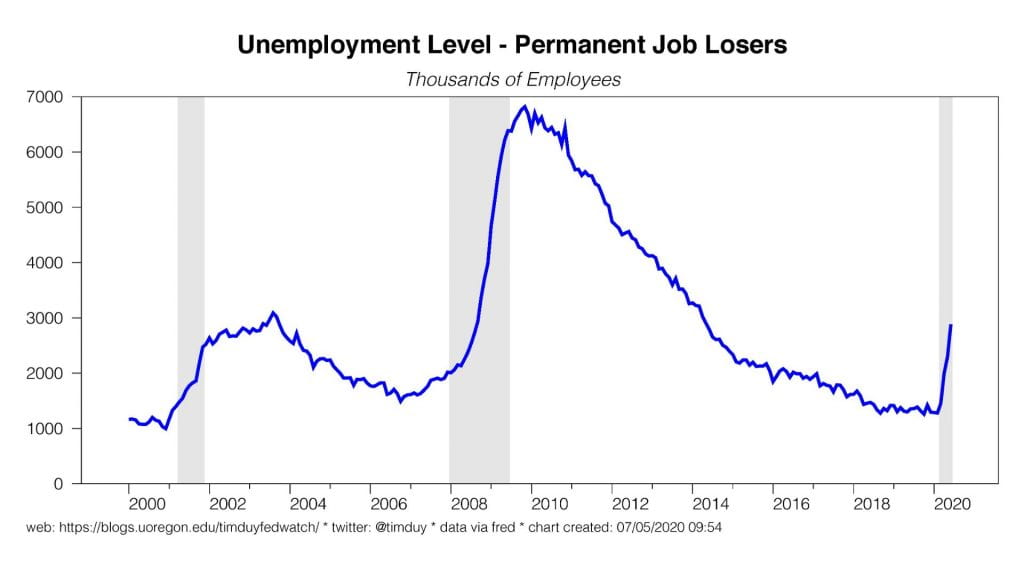

That climb back looks increasingly difficult. The early stage of the recovery will have dramatic gains such as seen in the last two months, but this is really just an artifact of the stop-start nature of this recession. Employment fell sharply because of the wide-ranging shutdowns of activity; some activity would certainly come back quickly. The recent pace, however, will certainly soon slow. A firm might be able to survive a month or two with no business, but a month or two of no business followed by 50% capacity will force it to either fold or employ fewer workers. This issue will be particularly prevalent in the leisure and hospitality sectors. Consequently, the job gains come back fast and furious at the beginning of the cycle but as the recovery drags on with subpar levels of activity, what where temporary job losses will become permanent losses. Indeed, this is already occurring with number of permanent job losses rising by 588,000 to 2.9 million.

Also important to note is that after the jump in average wages related to the initial change in the composition of the labor market because lower income people were the first to lose their jobs, average wages are now clearly in decline. I expect wage and salary declines will be much more common in this recession than the last as wages become less rigid in a downward direction, a testament to the size of the shock that struck the economy.

The Institute of Supply Management June manufacturing report revealed that the sector pulled back into expansionary territory. The logic behind the data is the same as that of the employment report. Many firms experienced a sharp and steep drop in demand and it was all but impossible that they would begin to stage a rebound with even a minimal improvement in demand.

Fedspeak

The highlight of the week was the minutes from the June 2020 FOMC minutes; I discussed the release here. The main surprise was that the Fed has yet to embrace yield curve control (YCC), a disappointing outcome to those anticipating a shift to YCC sooner than later. The Fed instead showed a preference from utilizing the existing tools of forward guidance and asset purchases. I think YCC is still likely, but that enhanced forward guidance will come first and then, as the recovery remains subpar, the Fed will feel pressure to do more and YCC will be the path of least resistance. Probably looking at 2021 before that happens.

San Francisco Federal Reserve President Mary Daly sees recovery in four to five years in the optimistic scenario. Via Bloomberg:

“If we can get the public health issues under control either through a really robust mitigation strategy or a vaccine, then we can reengage in economic activity really quickly,” Daly said Wednesday in a virtual Washington Post Live event. “Then it could take just four years or five years. But if we end up with a pervasive, long lasting hit to the economy, then it could take longer.”

Via the Wall Street Journal, New York Federal Reserve President John Williams sees the economy’s low point as behind us, but agrees that full recovery will take years. He downplayed the possibility of negative interest rates:

Mr. Williams said the choices the Fed will make will be determined by how the economy performs, and he offered no specifics about what sort of actions were on the table. But he pushed back at the notion the Fed might push its now near-zero interest-rate target into negative territory, saying guidance about the future direction of rates and asset buying offer more stimulative power.

Of all the things the Fed seems inclined to do, negative interest rates are at the bottom of the list.

Federal Reserve Chair Jerome Powell identified the most critical element of any recovery in his testimony to the House Committee on Financial Services:

Output and employment remain far below their pre-pandemic levels. The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.

More on that later. The general view is that the economy bottomed in April and has been gaining ground since, but the Fed is under no illusion about either the fragility of the recover or its role in sustaining the recovery. That role will require them to push policy further and they know it, they just don’t yet know the exact nature of that policy.

Upcoming Data

Fairly light data week. This morning we get a read on the services sector of the economy from both the ISM and Markit; the general expectation is improvement like seen in the general data flow. Tuesday brings the JOLTS report for May and its insights on labor market dynamics. The most important data of the week, initial unemployment claims, comes Thursday as usual. The pace of decline in the claims data has been disappointing; as faster pace of decline would provide an immediate boost to investor confidence. PPI numbers will be release Friday.

Discussion

The U.S. economic narrative is complicated. We know the economy has plenty of room for improvement and is in fact improving. But we also know that the recovery remains vulnerable to waning confidence among consumers due to surging Covid-19 infections. A wildcard in the mix is fiscal support; a premature reduction of fiscal support could light a fire at the base of the economy.

There is plenty of evidence that the economy is on the upswing. This had to happen once the lockdowns eased. Once activity fell to zero for many firms, there was nowhere to go but up. Unfortunately, Covid-19 infections are also on the rise with multiple hotspots such as Texas, Arizona, and Florida. Regardless of whether or not states renew lockdown orders, Powell’s concern that a lack of confidence will delay the pace of the recovery will be realized.

For example, the Wall Street Journal reports that dining is already taking a hit in states were Covid-19 cases are on the rise. This is a particular blow for restaurants that were counting a steady growth in customers to get them back on their feet. The simple fact of the matter is they can’t manage to operate without volume:

“Restaurants can’t live and survive by patio alone,” said Mr. Boomstra, a director in the firm’s restaurants practice.

I would expect a widening range of firms to see activity slow in places where the virus is growing unchecked. This, however, brings up a number of questions. First, will the virus hotspots lead to rolling slowdowns and closures or a virtual nationwide shutdown? If the former, the economy would likely manage to continue to climb forward albeit at a weak pace of growth. Second, will the embrace of masks in Texas lead to a general acceptance of masks as a pandemic fighting tool that turns the tide on the virus? If so, we could see cases roll back over by the end of the summer. Third, even if virus is brought under greater control later this year, will we be prepared for the fall and winter when many are driven back inside? Forth, even if we are not prepared, will there be a nationwide shutdown again by the end of the year?

Any of these paths lead to fairly similar monetary policy outcomes as none of them contains a rapid recovery. The economy has already sustained to much persistent damage in the form of firm closures and employee-employer separations. This explains the growing number of permanently unemployed (permanent in the sense that the previous job no longer exists). Without a rapid recovery, the Fed will be under pressure to take more action. Worse outcomes now will intensify the urgency, to be sure, but easier policy is coming sooner or later.

From an equity market perspective, these questions suggest a potential serious of sentiment shifts on the horizon. The worst outcome is of course a renewed nationwide lockdown. A series of rolling shutdowns would be less damaging and equity market participants would likely view such a situation as one of general improvement and thus try to look forward to the other side of this whole mess. That outcome, which seems highly likely suggest to me that further equity gains will be hard to come by. I am intrigued by the possibility that the cases begin a descent by the end of the summer; that situation would seem to set the stage of an equity rally.

A wildcard in this whole situation is the expansiveness of the next fiscal support package. The generally positive data flow could lead to a less expensive fiscal package. Such an inclination would be a mistake. The expanded unemployment benefits in particular are providing critical support at the base of the economy and is almost certainly the reason retail sales and consumer confidence are holding up better than might be expected given the magnitude of the shock. It allows workers to cover their fixed costs, which includes paying the rent and mortgage. Think of it as “trickle up” policy. If the base of the economy suddenly fell over a fiscal cliff at the end of this month while the virus prevents a full recovery and the second and third order impacts of the initial shock are still flowing through the economy, a cascade of bankruptcies and foreclosures could wreak havoc on the financial sector.

Because the negative consequences are so severe, I find it hard to believe that Congress won’t find a way to continue to pump money into households, albeit perhaps via less generous benefits.

Bottom Line: The economy is improving, but even in a best-case scenario the Fed will be easing policy further. They aren’t ready for yield curve control but I suspect will get there. Surging Covid-19 infections will sap confidence in the economy. Rolling shutdowns might not bring the equity market to its knees like we say in March, but they wouldn’t be supportive of further gains. Seems like more room for negative than positive sentiment this month, but watch for the possibility that case numbers roll over later in the summer. That might happen if mask wearing becomes almost universal and they work to slow the pace of infection. In any scenario, Congress needs to maintain fiscal support.