Federal Reserve: Loose for longer

The Federal Reserve has left monetary policy unchanged and continues to warn of major downside risks to growth. With officials signalling policy will remain ultra loose for at least the next couple of years, the short-end of the curve will remain anchored with the prospect of some modest curve steepening while the dollar sell-off looks set to gain momentum

Key points from Fed decision

- No change to policy rates or QE – purchases to be maintained “at least at the current pace”

- Reiterated that the 0-0.25% fed funds rate range would be maintained until FOMC members are “confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals”

- “Dot Plot” median forecast has no rate hike before end-2022 with just two out of 17 FOMC members looking for higher interest rates in 2022

- No-one is forecasting negative rates

- Long run expectation for Fed funds rate left at 2.5%

Fed "dot plot" forecast for the path of interest rates

No relaxation as worries linger

The Federal Reserve policy meeting and accompanying statement were largely as expected. There were no policy changes with the Fed funds target rate left at the 0-0.25% range. It will stay there until the Fed is confident the economy is on the mend. “Over the coming months” they will maintain QE purchases of Treasuries and MBS “at least at the current pace”. There were no dissenters.

The language elsewhere is left unchanged with minor tweaks to reflect better functioning of financial markets. The Fed continues to emphasise the "considerable risks” to the outlook and the obvious point that the pandemic will “weigh heavily”.

The forecasts contain the more interesting aspects and there is near unanimity that rates will not be increased anytime soon – just two out of 17 FOMC members expect to see a rate rise before the end of 2022. Nonetheless, the Fed did not lower its long-term assessment for the Fed funds target rate from 2.5%, which was a bit of a surprise given the potential for the pandemic to potentially have a long-term structural impact on the economy and key industries such as travel, commercial real estate, etc.

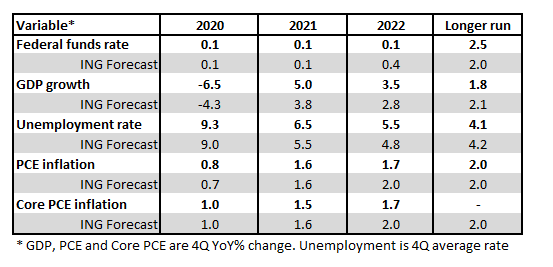

The Fed are more pessimistic on growth this year than we are, expecting the 4Q year-on-year growth rate to be -6.5%, but they consequently see sharper growth in subsequent years. They also are of the view that there will be long-term implications for the labour market with the unemployment rate seemingly slow to fall. Nonetheless, there is a huge range of expectations within members and no-one is going to have particular confidence in their predictions given the current situation.

Federal Reserve forecasts versus ING

The long road to recovery

The outlook for policy remains highly uncertain. While equity market and other risk assets are seemingly pricing a V-shaped recovery, the Treasury and interest rate futures markets are much more wary. We think caution is warranted and see little prospect of the Fed moving towards tightening monetary policy anytime soon. Instead we see a greater chance of more stimulus.

Firstly, we simply do not know what path the virus will take. States that have started to re-open early have seen some evidence of a pick-up in cases versus those that have stayed under lockdown. Should the number of cases increase this could see calls for containment measures to be reinstated. Moreover, we remain concerned about a potential for the virus to regain a foothold as we head into winter and conditions are more conducive to transmission. With little to indicate a vaccine is imminent it is far too soon to relax about the potential health and economic costs.

Then there is the general social distancing, consumer caution and travel restrictions that will prevent a return to pre-Covid-19 economic “normality” while even after last week’s shock payrolls report, we have to remember employment is still 19.5 million lower than in February. Throw in the threat of corporate defaults given rising debts and falling revenues and profits, the potential for trade tariffs, plus social and political tensions having a negative feedback on the economy and it is clear there are many obstacles for the economy to navigate.

We don’t see negative interest rates as being realistic given zero enthusiasm from Fed officials (it hasn’t worked in Europe or Japan and could actually be detrimental to credit availability. More QE that is specifically targeted at capping borrowing costs, so called Yield Curve Control, is possible. However, with Treasury yields looking well anchored right now there is no urgency. It would more likely come about if rising Treasury issuance was leading to indigestion in the bond market and pushing yields higher, leading to tighter financing conditions more broadly in the US.

Market implications

Treasuries:

The 2yr has been anchored in recent weeks in the 20bp area. That has in turn been supported by the forward guidance provided by the Fed, and the break back below 20bp has been the key immediate outcome. Some steepening from the front end has been the consequence, and some more of that is likely ahead to the extent that risk assets maintain a positive tilt. We maintain our view, however, that the structure of the curve is not one that looks like a bear market for bonds, and the belly is too rich versus the wing. In fact, the rates market maintains a significantly less cheery outlook compared with risk assets. Should risk-on be sustained, reversion of the 10yr towards 1% is a likely path of least resistance, eventually. From the Fed though there is a clear message that rates should remain contained for the foreseeable, which will limit any upside test. Bottom line expect the curve to remain directional (anchored by the front end).

FX:

Dollar sell-off gains momentum

After an initial wobble, perhaps on the view that the Fed did not deliver any fireworks on the QE front, the FX market has resumed its recent love affair with risk assets and taken the dollar lower.

The broad trade weighted dollar is within a whisker of return to the mid-March lows, right before the USD funding markets seized up and the dollar hoarding story developed. No doubt investors are jumping on the view that the FOMC median expectation was for unchanged Fed rates right through 2022, maintaining demand for higher yielding assets – including EM.

EUR/USD has now traded through 1.14 and we have a near term target in the 1.15/16 area. Adding weight to the broadening dollar bear trend is the fact that the JPY has rallied as hard as the EUR today against the dollar. Up until recently the JPY had been underperforming on a steeper US yield curve and the global reflation trade. Over the last few days price action in USD/JPY now suggests that investors are sinking their teeth into a cleaner FX story – one of a broad-based dollar decline.

Download

Download snap12 June 2020

In case you missed it: There may be trouble ahead This bundle contains {bundle_entries}{/bundle_entries} articles