If there is one small silver lining from 2018’s economic performance, it is that Milton Friedman’s interest rate fallacy is being robustly proven yet again. Many Economists will have you believe that low interest rates, short or long, are stimulus. This is a huge mistake. Here’s what Friedman said in December 1997:

As the economy revives, however, interest rates would start to rise. That is the standard pattern and explains why it is so misleading to judge monetary policy by interest rates.

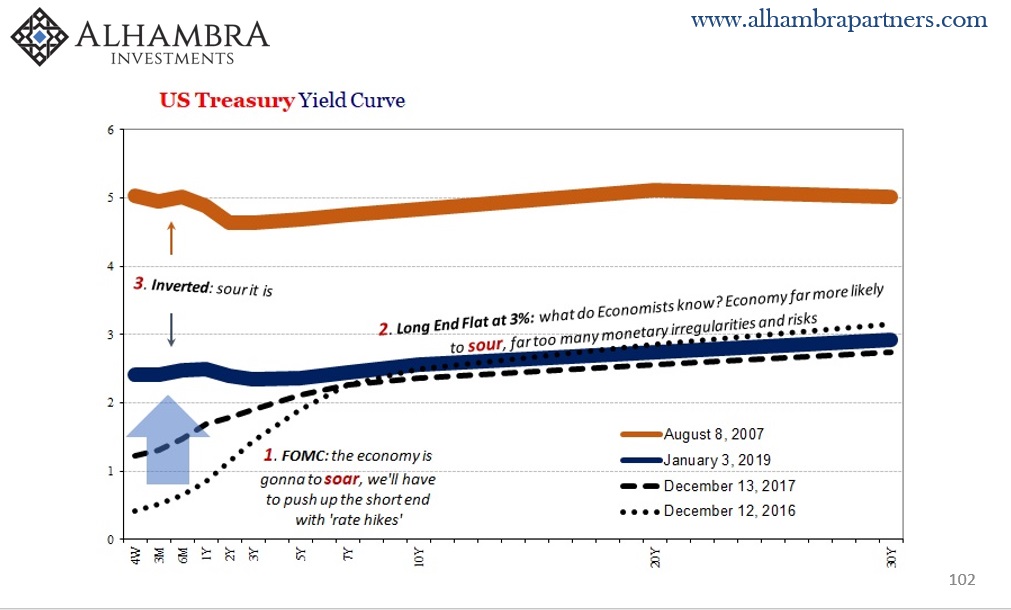

When he said that, interest rates across the world were very different from where they are now. In the US, the federal funds target at the time was 5.50%. Was the economy of 1997 destroyed by what might seem today an incredibly high money rate? Of course not. The two go together, that’s the fallacy.

Good economy, robust opportunity, realistic rates.

As the global economy falls apart again (the fourth time in the same series) some people including many politicians are blaming central bank “rate hikes.” Are we really supposed to believe that the Fed pushing the upper limit for federal funds to 2.50% is some sort of massive economic burden?

No. The fact that interest rates “can’t” rise is reflective of the fallacy; the economy is awful because money is already tight, therefore interest rates at both the short and long end are stuck in what seems like a trap. The world was obviously fine at 5.50% and is only different shades of awful at 2.50% and less. People can’t grasp the simple reality because Greenspan and his 25 bps distractions.

There has been no stimulus here. Monetary policy has been worthless because it is moneyless.

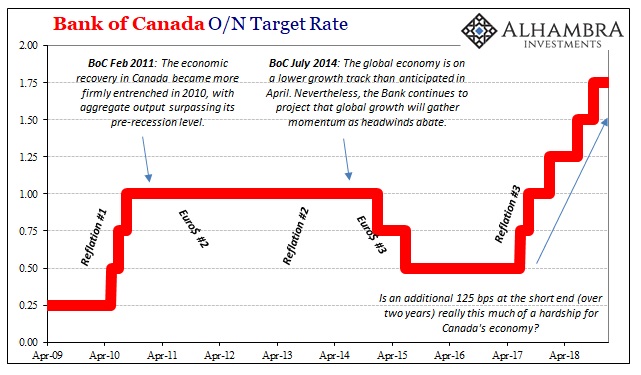

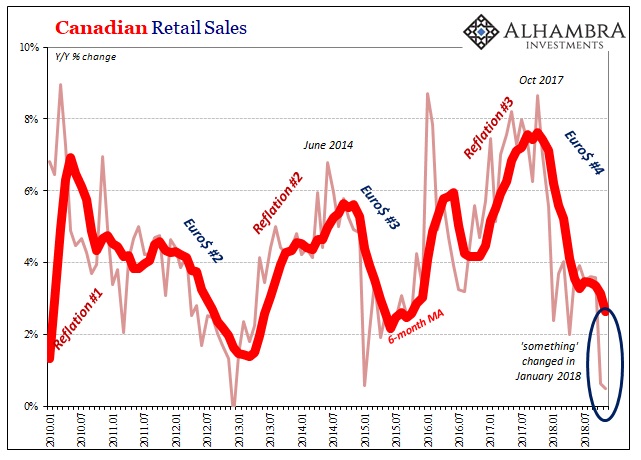

In Canada, the central bank has been mirroring the Federal Reserve at an even more cautious pace. It has been raising its benchmark overnight rate since July 2017. Starting from 50 bps, the last “hike” back in October pushed it up to all of 1.75%. Is 125 bps to blame for what you see below:

Canadian retail sales have nearly crashed in the past two months; only, the last two months of data are October and November. There was barely any growth (year-over-year) in them and that was before what took place in December.

Like Germany’s industrial figures or China’s trade, Canada’s retail sales tell us the global economy was already very weak heading into last year’s last quarter. Once again, some additional commentary on why December was such a global mess.

This is a forming worldwide slowdown, one that seems to be only at its beginning. For an undetermined amount of time, many people will be relieved by central bank pauses or even reversals when they come. But only until they are made to realize “rate hikes” were never the problem.

The world was much better when interest rates were far above where they’ve been parked over the last eleven years. QE wasn’t, and is not now, responsible for them being held so low all this time; Friedman was right instead to note the fallacy. It isn’t that the economy can’t manage slightly higher rates, rather the economy represented by low rates is prone to falling back again long before policy rates can get very far.

That’s the trap. Economists who can’t read the economy nor bond markets properly.

Stay In Touch