Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Spectra School is Coming!

In a few weeks, we will be launching our flagship Spectra School course:

Think Like a Market Professional

Join the waitlist before launch to receive a major discount and other sweet treats on Day 1.

Sign up for the waitlist now, with no obligation

https://spectramarkets.com/school/

The Course Includes:

- 16 long-form written online lessons.

- 8 long-form “Learning from Legends” videos featuring (in alphabetical order) … well-known Wall Street experts like… Danielle DiMartino Booth, Matt Gittins, Jim Grant, Tony Greer, Ben Hunt, Leland Miller, Alf Peccatiello, and Sam Rines. (What an insane lineup!)

- 7 short-form “Behind the Screens” videos covering specific market topics.

- 2 hours per month of live discussion / AMA / Q&A with Brent Donnelly and Justin Ross.

- Online exams and certificate of completion.

Here’s what you need to know about markets and macro this week

Global Macro

This week was not for the faint of heart as we saw a toxic mix of small, medium, and large geopolitical, macro, and idiosyncratic shocks. Stocks lost a chunk of their value, carry trades blew up in FX, and liquidity all but vanished in many markets, including S&P futures.

Let’s go through the big stories one by one. Not in chronological order.

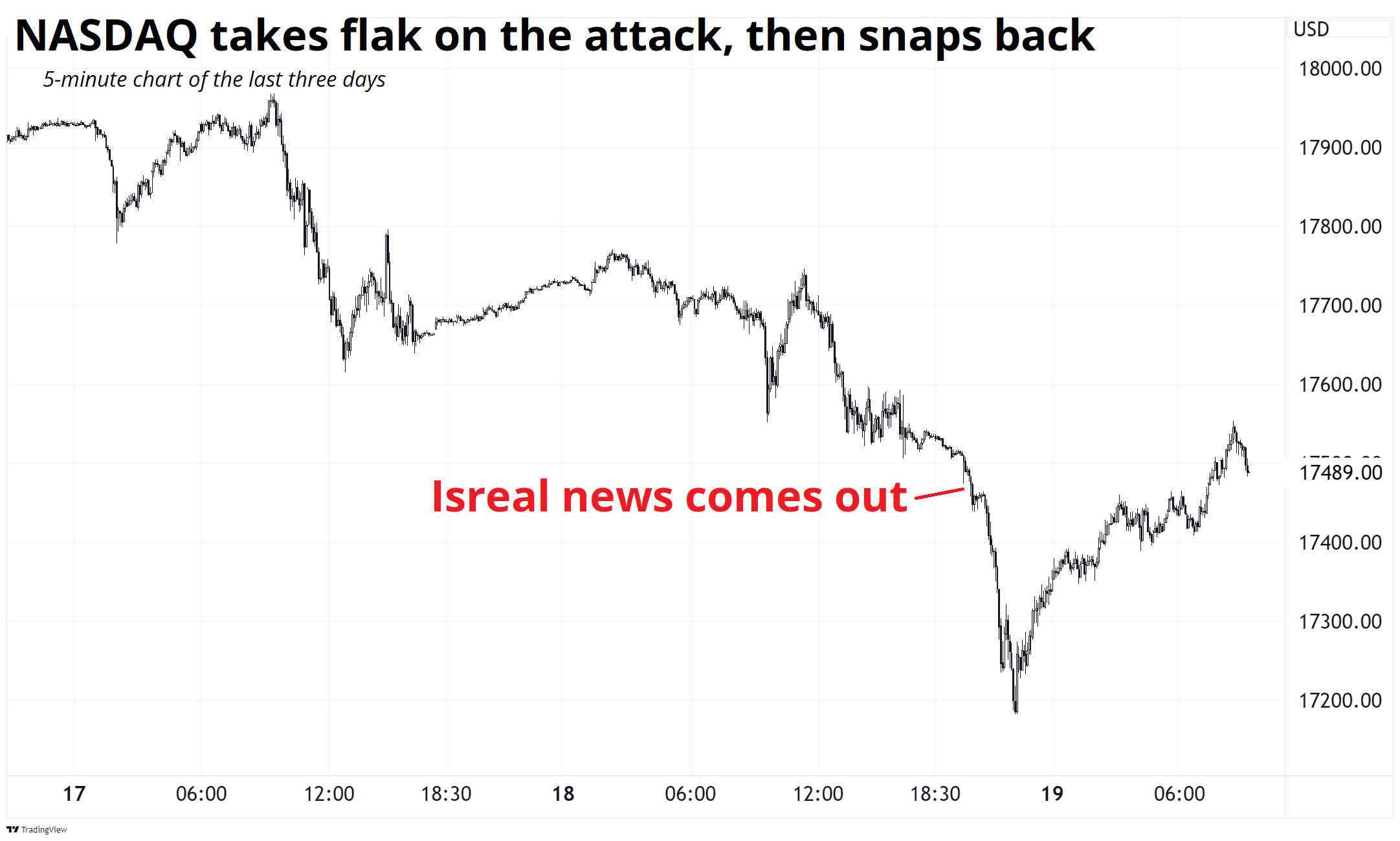

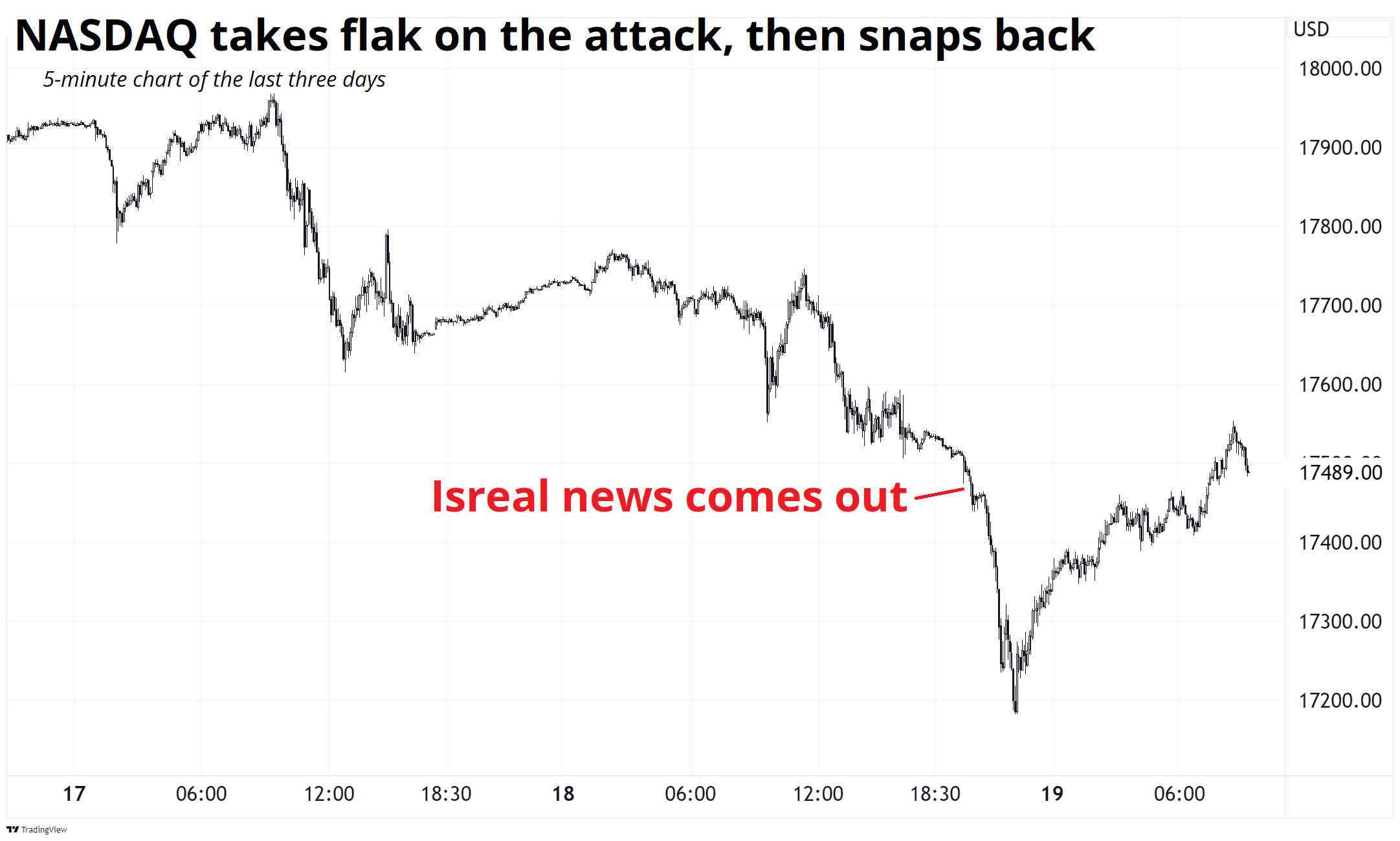

More money has been made fading geopolitical news than trading it directionally over the years, and last night’s market clowning was no exception. News dropped that Israel was attacking Iran, and that is obviously scary stuff. The news came out in Asian time, where liquidity tends to look like this after news comes out:

Market observers have been waiting with bated breath for the carry trade to blow up as it has been en vogue for 18 months and is mucho crowded. They finally got it last night. The Mexican peso has been the dream currency for more than a year as it offers a juicy yield plus tons of nominal appreciation. A free lunch, almost. A popular expression of the long MXN trade has been long MXNJPY because JPY is a low yielder that works well as a liability currency for shorts.

Here’s a chart of MXNJPY this year:

The thing about geopolitical news is that it’s very rarely important for more than a few hours. I could list grillions of these events, and very few had any lasting impact on markets. People hit the panic button on the headlines (which is easy to understand!) but most of these news drops end up as fades, not trades. 9/11 and Russia’s invasion of Ukraine had a lasting impact, but these one-off news events are more common than those needle-moving watershed moments.

Here’s how NASDAQ futures reacted:

While the news in the Middle East was a red herring, the moves in interest rates were not. Markets were heavily influenced by the continued repricing of Fed policy. We came into this year pricing six rate cuts from the Fed (and maybe 10!) and as long as the distribution was skewed to rate cuts, people could remain chill.

But as the hike side of the distribution opens up a bit, there is reason to play defense. Upward moving interest rates and the uncertainty they bring are completely different from a reduction in the number of cuts. That is, whether we’re looking at 6 cuts or 3, the market is still happy. Yay, cuts! But if there is a real chance of US interest rate hikes, that’s a different macro paradigm. Boo, hikes.

Yields have been moving inexorably higher this year as the economic data in the US remains unflinching. We got more solid data this week, and then the Fed’s John Williams, an influential voice, said the thing that bulls didn’t want to hear:

*WILLIAMS: RATE HIKE NOT BASELINE, BUT POSSIBLE IF DATA WARRANTS

Now your first reaction might be like: OK, but what is the context? The context was pretty simple. It was a straightforward question about whether or not hikes are possible.

Williams had two options. He could have said something similar what his boss said just two days earlier, which was:

“If higher inflation does persist, we can maintain the current level of restriction for as long as needed. At the same time, we have significant space to ease should the labor market unexpectedly weaken.”

In other words, holding rates steady is hawkish because rates are already mega restrictive. Instead, Williams said something different. Something that suggests that the Fed’s losing their mojo on the rate cuts thing and sees a non-zero chance they might need to hike.

Stocks

Stocks went down all week as Tax Day selling piled onto more selling and that selling continued when Williams dropped the H word and Israel struck Isfahan. Despite the big rebound post-Iran news, the NASDAQ is still down around 500 points this week, or ~3%. While the moves have been steady and mildly concerning for bulls, disappearing liquidity may have made things worse.

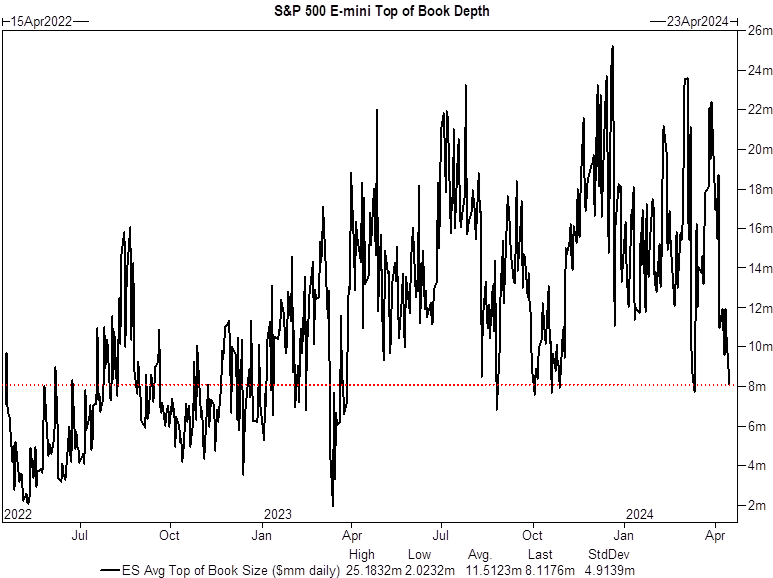

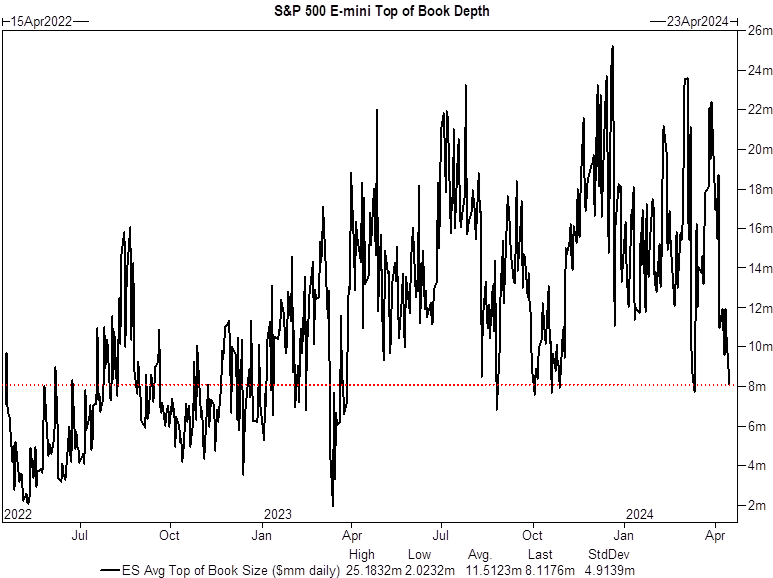

You saw the MXNJPY move in Asia, which was substantially accelerated due to lack of liquidity. And take a look at top of book in S&P futures. Mamma Mia.

Chart via Goldman Sachs

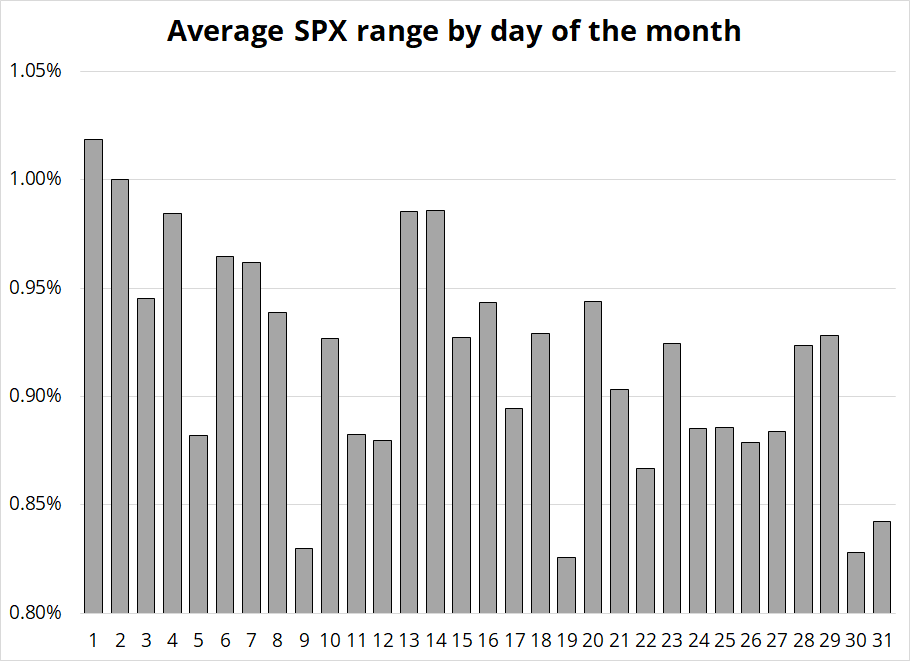

The question now becomes whether or not there is enough bad news to push stocks lower over the next two weeks. My best guess is: No. The rest of April will feature a Fed blackout (gracias a Dios), plus there tends to be much less market-moving economic data as you pass the 15th every month.

US economic data is front loaded with ISM and NFP at the start and CPI in the middle. We get PCE near the end, but that is easy to forecast with so many clues provided by CPI and PPI and thus PCE release tends to offer little new information (or volatility) for markets.

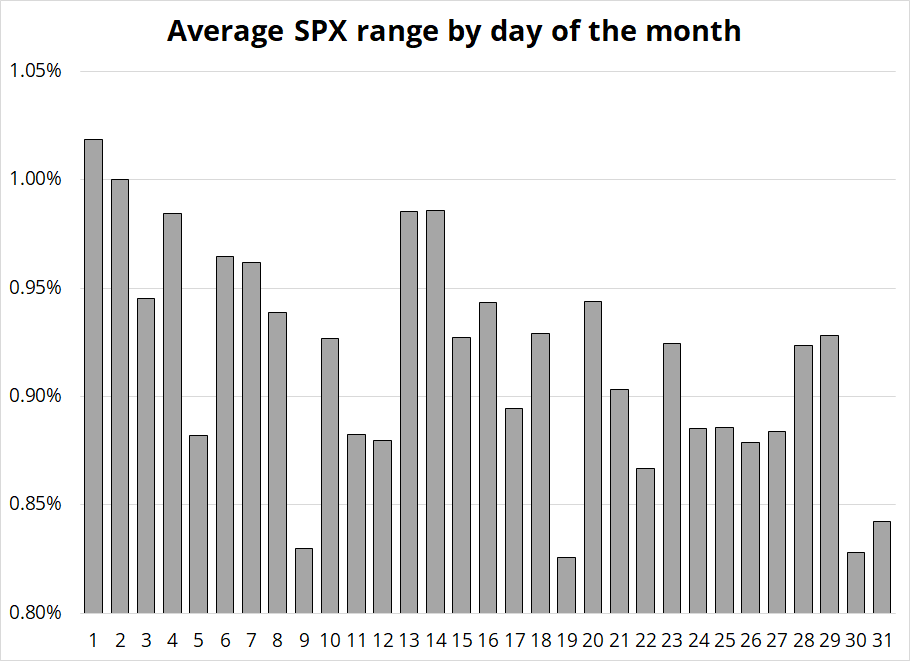

You can see this if you look at the volatility of various products by day of the month. The front half of the month is more volatile. This chart shows SPX volatility by day of the month since 2009.

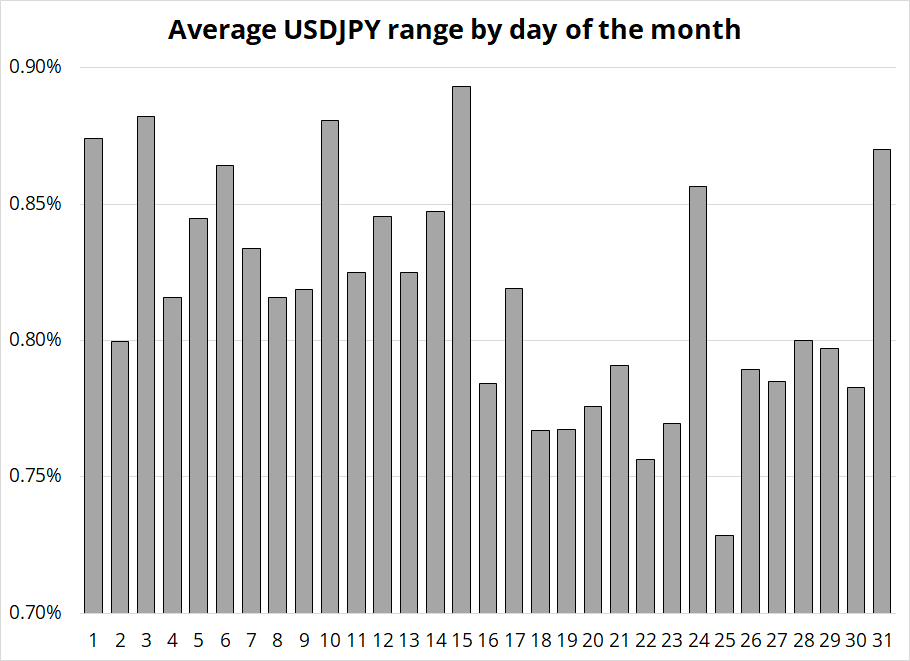

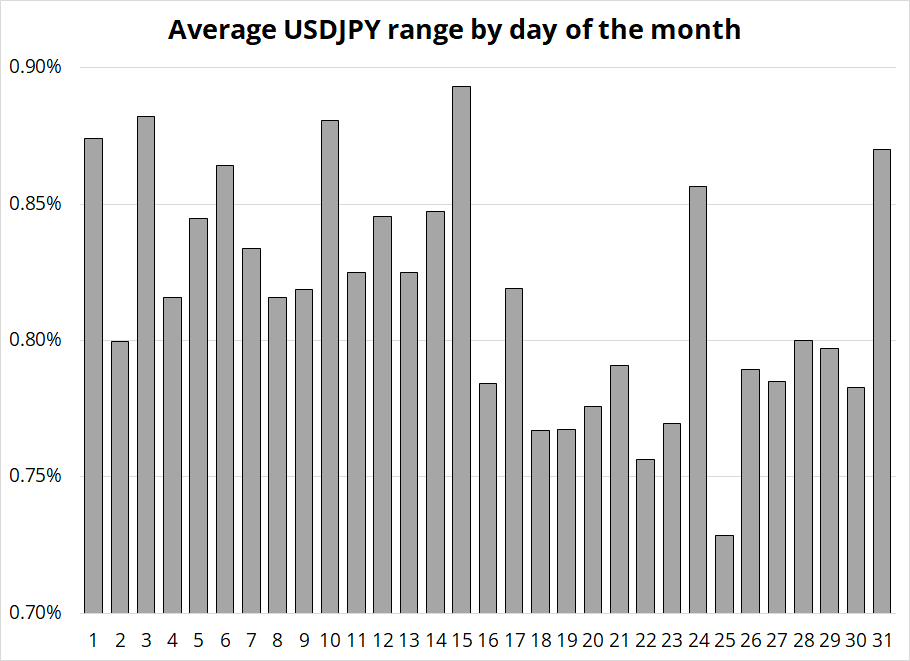

You can see in that chart that the start and middle of the month, when US data gets released, are more volatile than the other periods. Same for USDJPY.

I think we are entering two weeks of lower volatility as the NASDAQ selloff consolidates and there will be very little new macro information.

While the US stock markets swooned, global markets dumped, too. Japanese stocks, which have become increasingly popular since Warren Buffett jumped in the pool, are a cool 4000 points off the highs and back below the 1990 bubble peak.

Here is this week’s 14-word stock market summary:

The trend lower should stall as we enter a bounce/consolidation phase. VIX shrugged.

Interest Rates

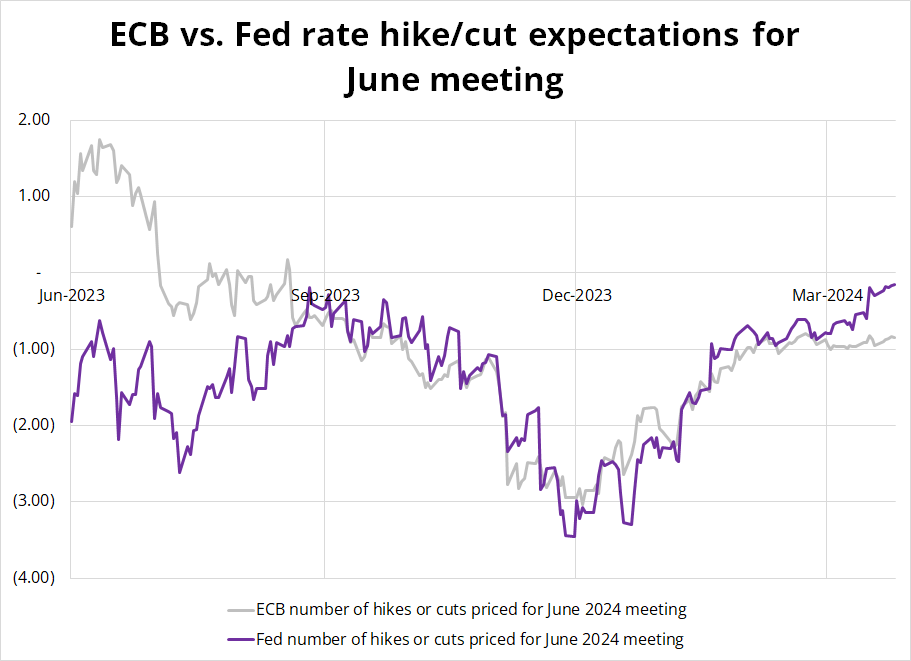

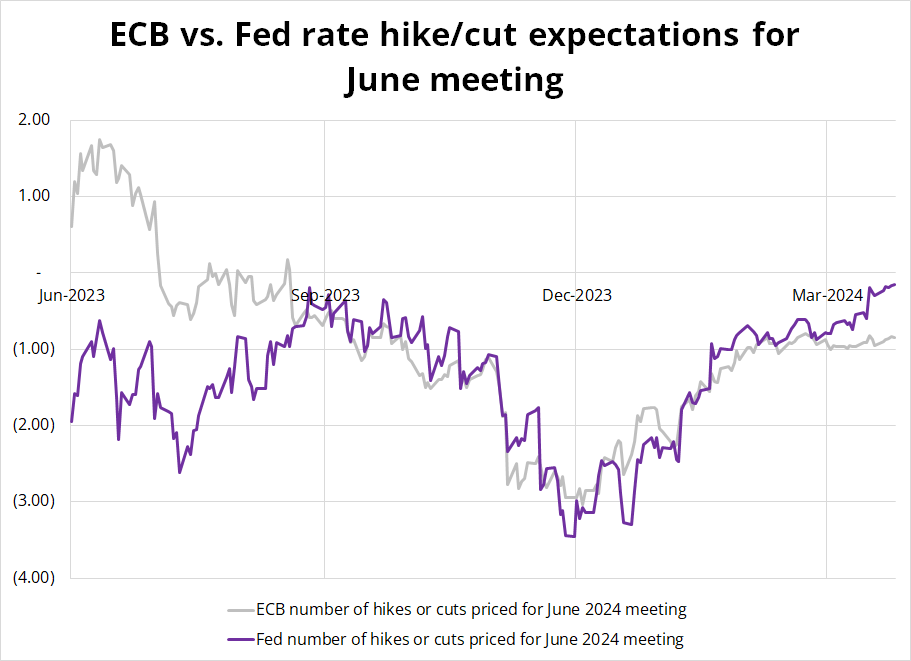

There is a decent story of divergence as the ECB, SNB, and BoC are set to cut rates in June while the Fed is probably not cutting anytime soon and maybe might hike again someday. The divergence in back in yields is more dramatic, but here is the evolution of expectations for the June meeting of the ECB and the Federal Reserve.

Notably, the market had more priced for the ECB back in ye olden times (2023) but you can see the Fed (purple line) has recently diverged from the ECB as the Europeans have all but promised to cut on June 6 while the Americans have all but promised they will not.

While Williams set the cat amongst the pigeons a bit, interest rate volatility hasn’t gone that high. I have written about this repeatedly, so I will not go into much detail here, but it’s my view that interest rate volatility is the most important driver of asset prices in both directions in the current sticky inflation regime. The direction of yields matters, obviously, but vol matters more. Rising yields rising fast are scary. Rising yields grinding higher are not.

Fiat Currencies

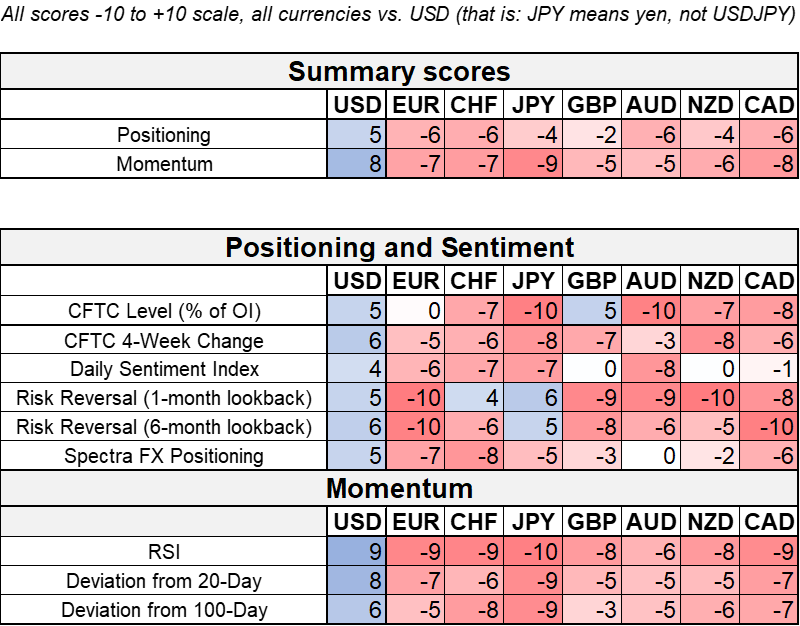

The divergence in interest rate policy has pushed people back into the long USD trade and punters are getting short euros, CAD, CHF, and so on. Call me boring if you want, but this chart doesn’t exactly scream “GET INVOLVED!”

In fact, I would be more inclined to think we stay in a rangebound regime for FX, and I prefer to be short USD here, not long. There are a few reasons for this, including positioning.

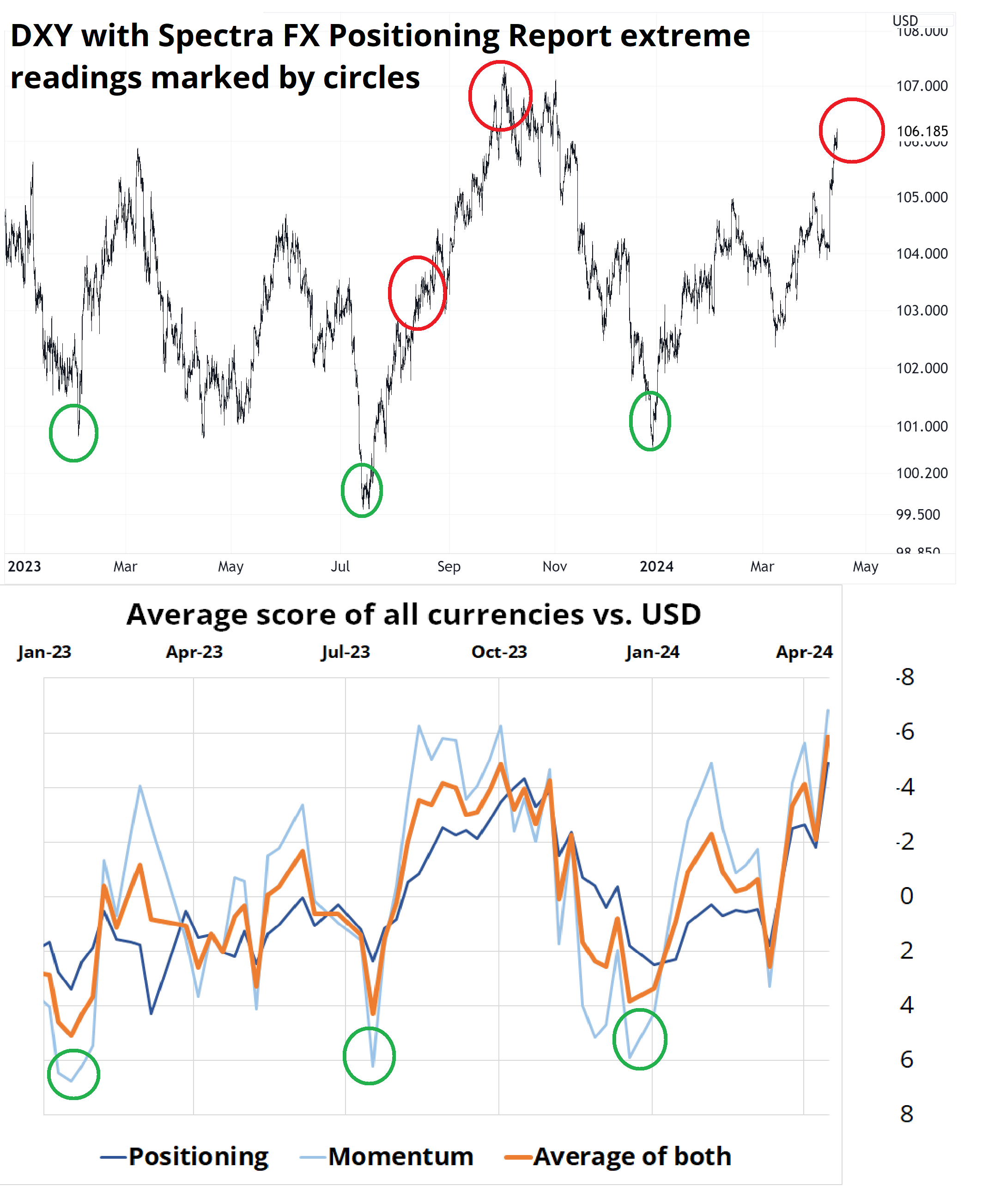

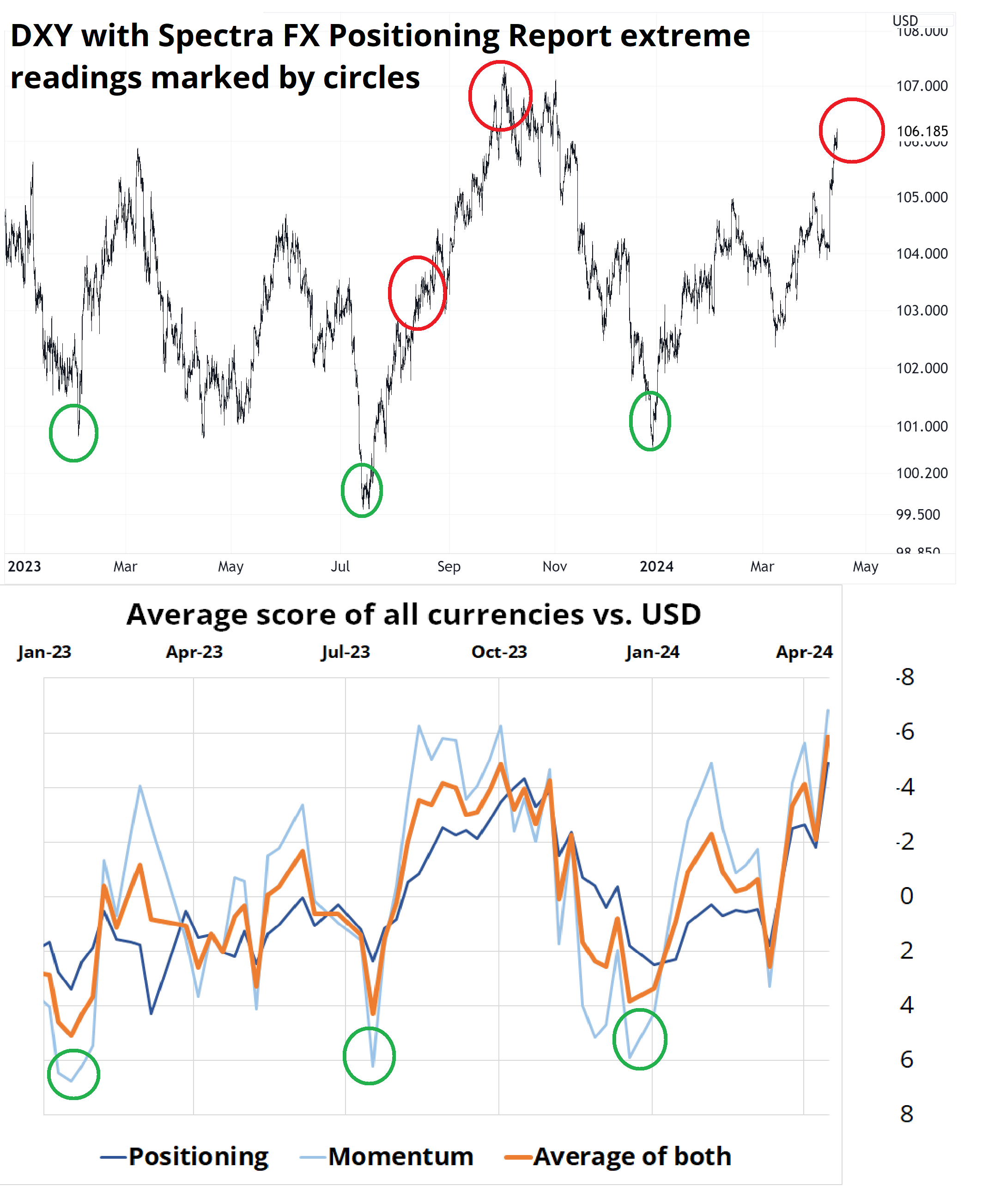

We have been running a weekly FX positioning report at Spectra since October 2022 and the readings this week are the most extreme so far. Both long USD momentum and long USD positioning have touched never-before-seen levels. This touching of the extreme does not have a perfect record in forecasting USD turns, but it’s pretty close as it’s identified an important turning point four out of five times. That said, the DXY has been in a range the whole time so that could be overstating this indicator’s ability to pick the turns because mean reversion signals work best in rangebound, not trending markets. Here’s the data in chart form.

At Lehman Brothers, we got a report showing the total dollar position for the firm, and it looked identical to the bottom panel and had similar predictive power. Whenever the firm’s position exceeded $2 billion long or short, the dollar would turn shortly after. If Lehman was around today, the USD position would probably be around long 2B.

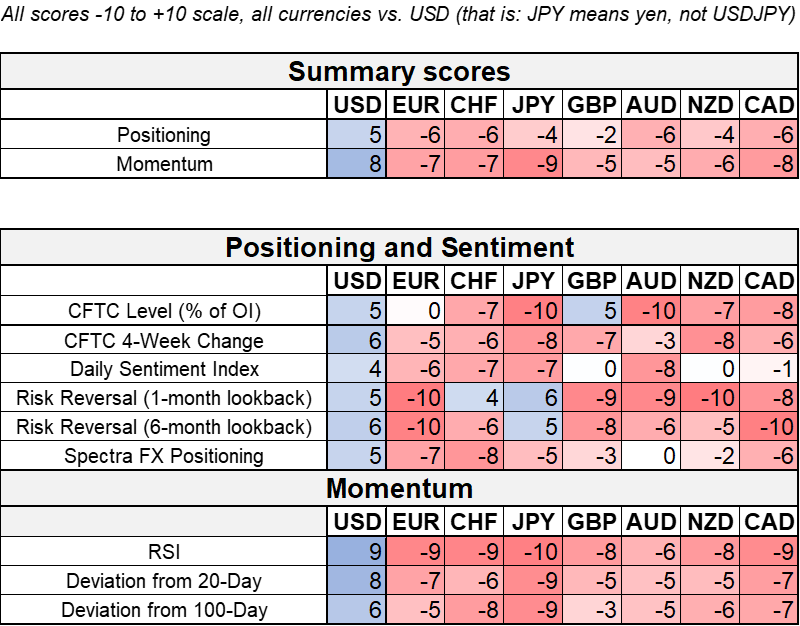

If you look at this grid, you can see that the most extreme USD pairs are EURUSD, USDCHF, AUDUSD, and USDCAD. So, if you’re looking for a reversal, those are the places to look. USDJPY and NZDUSD too, I suppose. Anything but GBPUSD, where the CFTC remains long and the DSI (Daily Sentiment Index) hasn’t turned at all.

Spectra G10 FX Positioning and Momentum Scores

With no important data on the docket, the market mega long USD, and the Fed having thoroughly repriced, the asymmetry for the dollar is to the weak side. That said, prior tops in the dollar have been choppy and frustrating, not inverted Vs. So, I’m not short USD yet.

Adding to my view is a chorus of pushback on the strong USD by officials in Japan, Korea, Sweden, and elsewhere. When all the global policymakers fall in line on currency policy, it’s important to take notice. This is exactly what happened when the dollar topped in September 2022 and October 2023.

Finally, we all continue to wait with bated breath to see whether or not the Japanese Ministry of Finance (MOF) will intervene again in USDJPY. The yen is incredibly weak and the rhetoric from officials is clearly signaling displeasure. To me, it’s a matter of when, not if.

Crypto

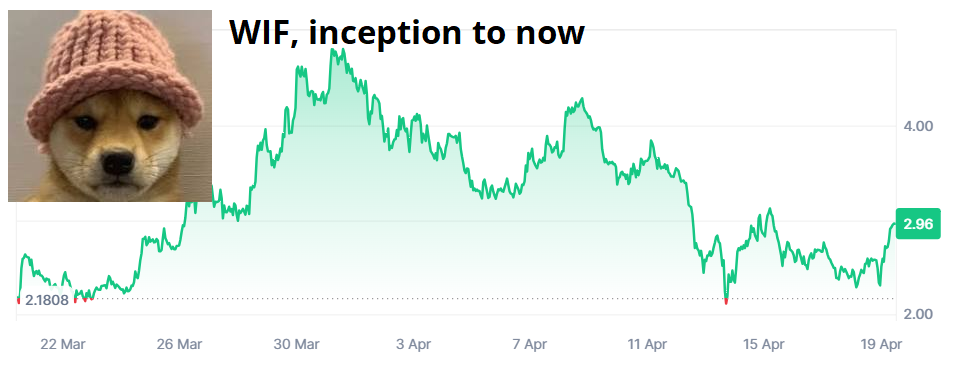

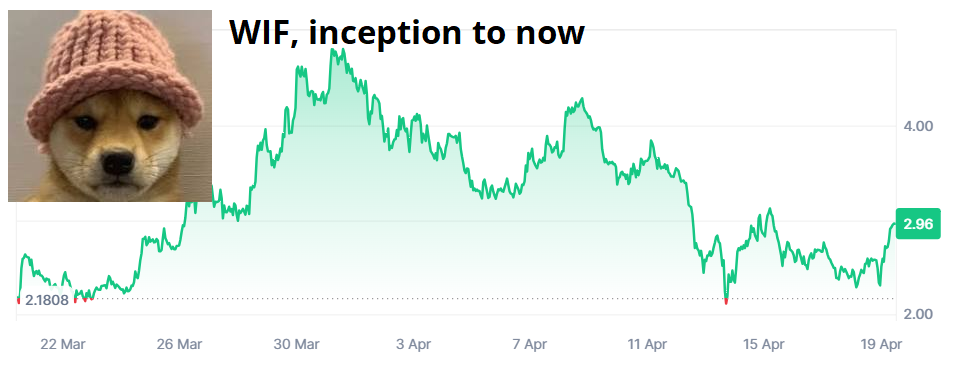

Crypto is getting slapped around as the Middle East news triggers panic liquidation, but the second abject panic dissipates, BTC recovers. Even memecoins like WIF have held in quite well and that particular unregulated security has traced out a nice double bottom at $2.

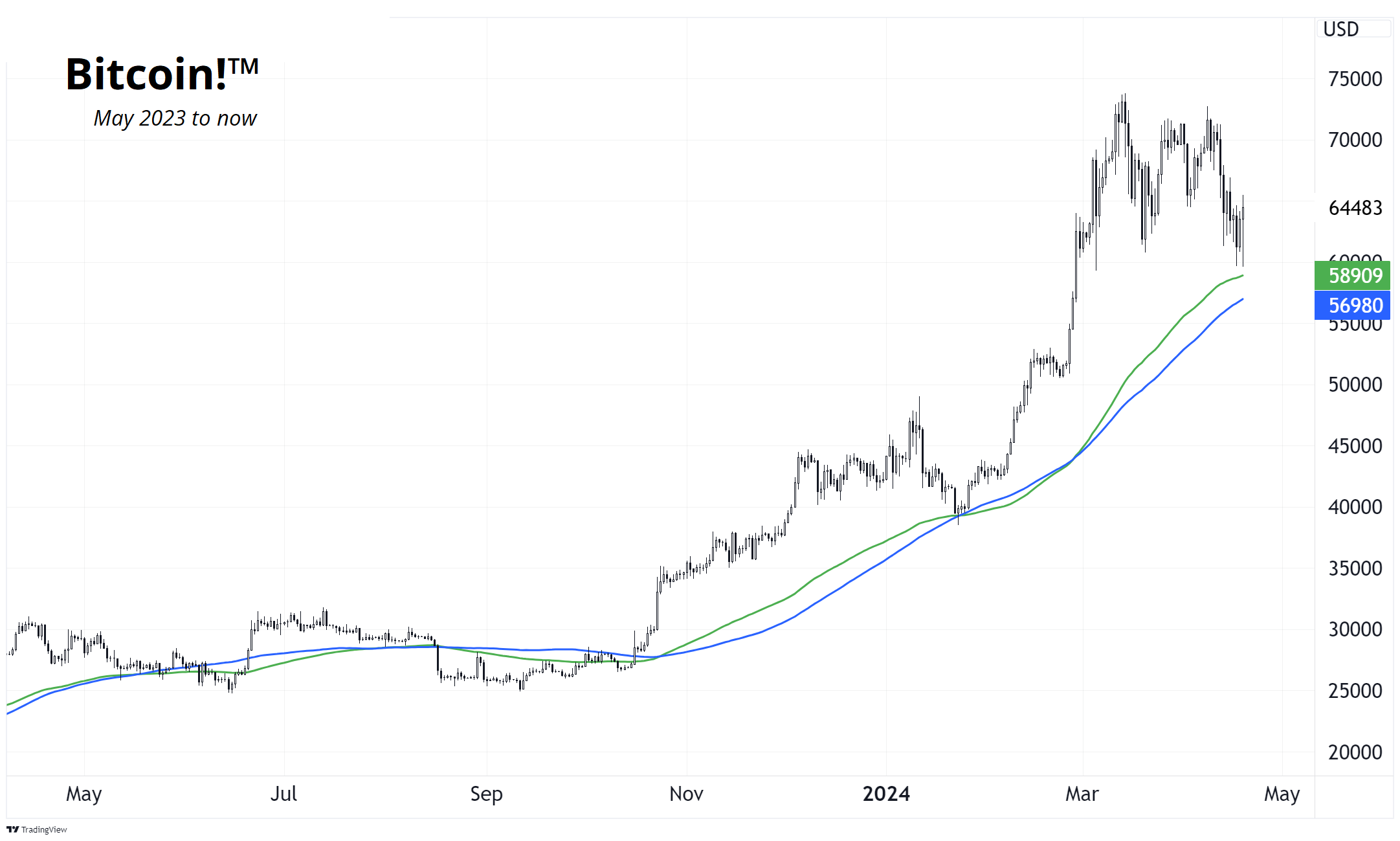

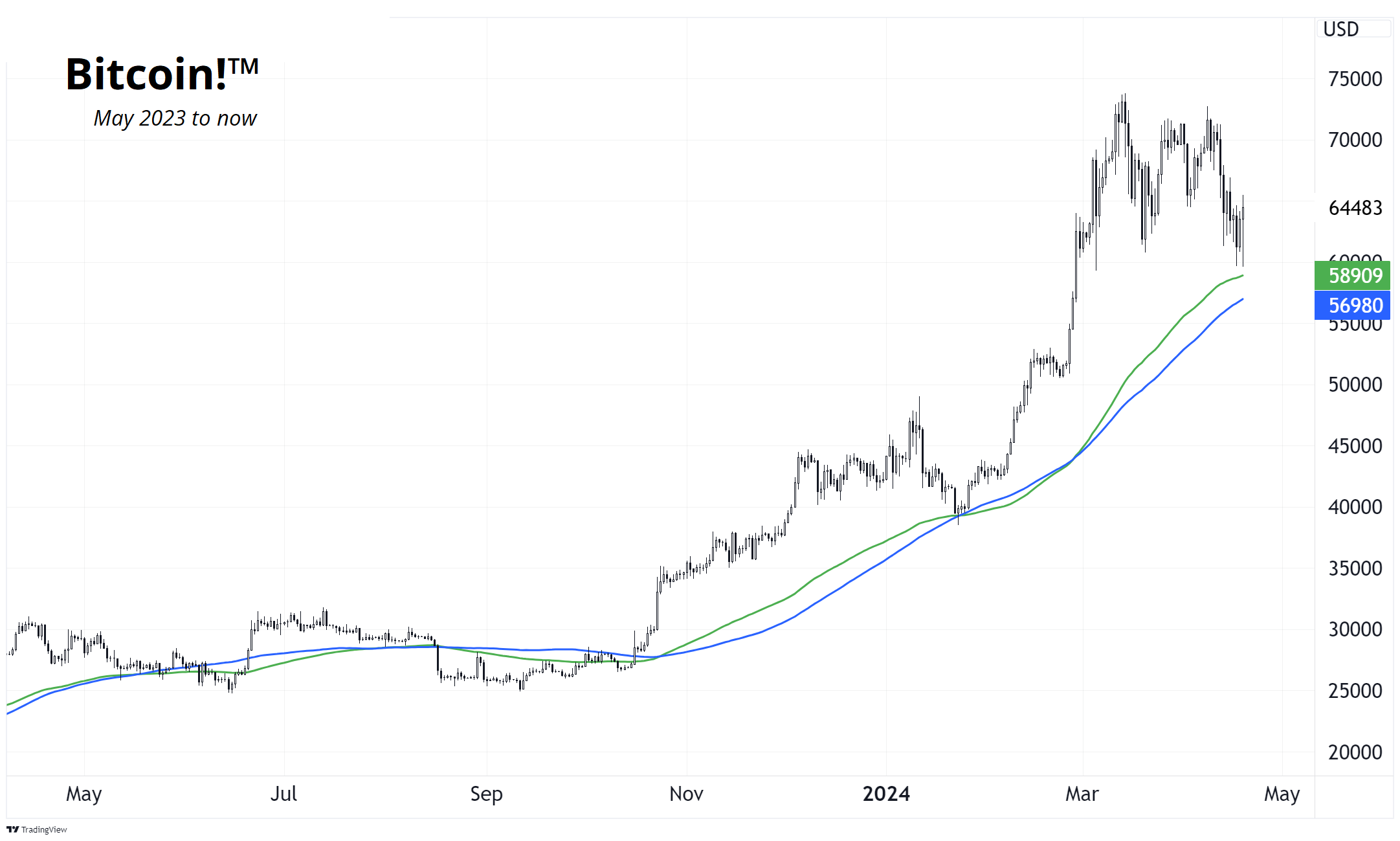

Bitcoin is chopping around but holding the March lows and also respecting the 100-day moving averages. This next chart shows how the ETF excitement propelled bitcoin up through the moving averages (I show the simple and exponential 100-day moving averages on the chart). We then retested those averages in late January, and they now sit at 57k/59k. That should be the buy zone if the uptrend is still in force. Through 57k is ruh roh.

Commodities

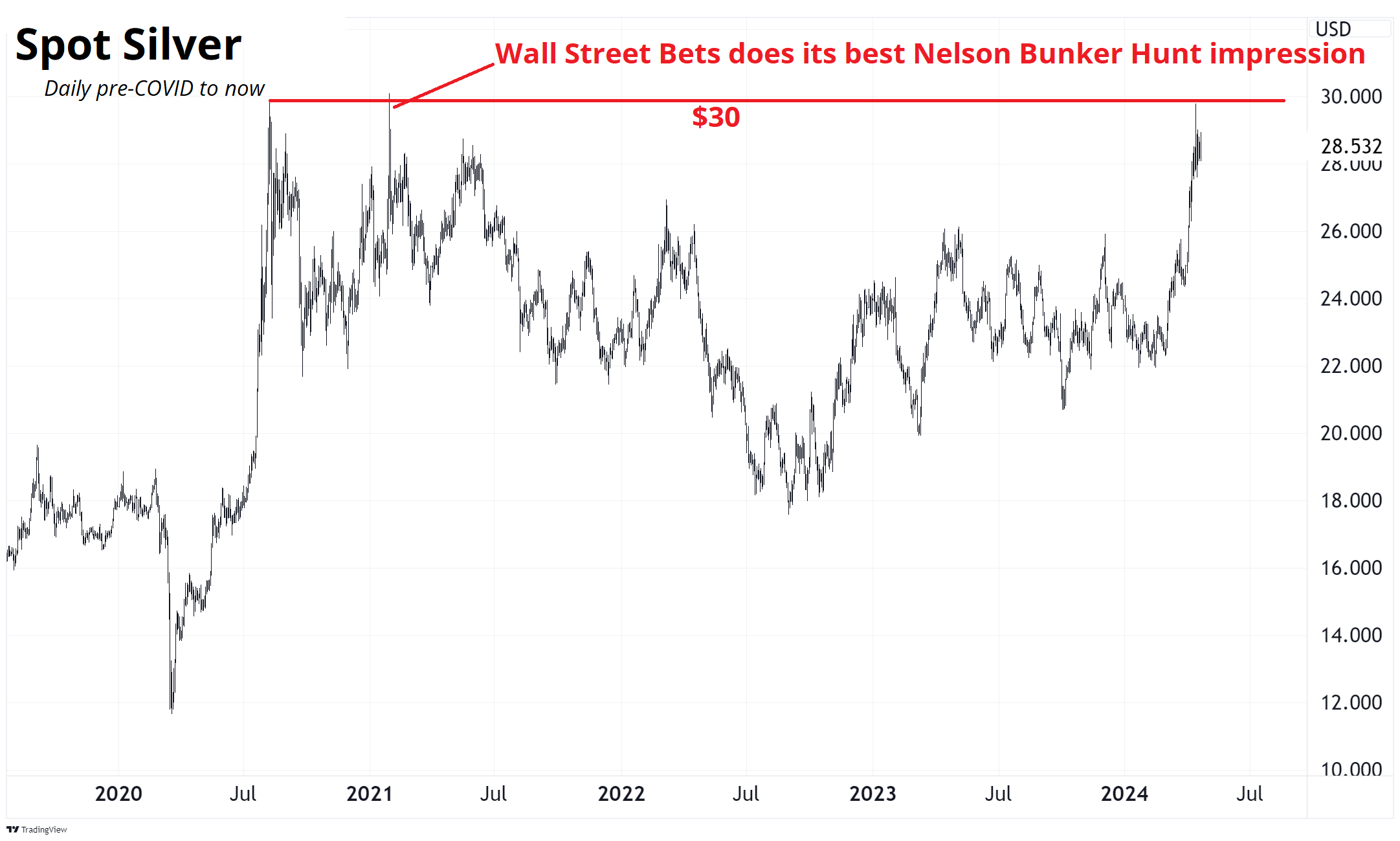

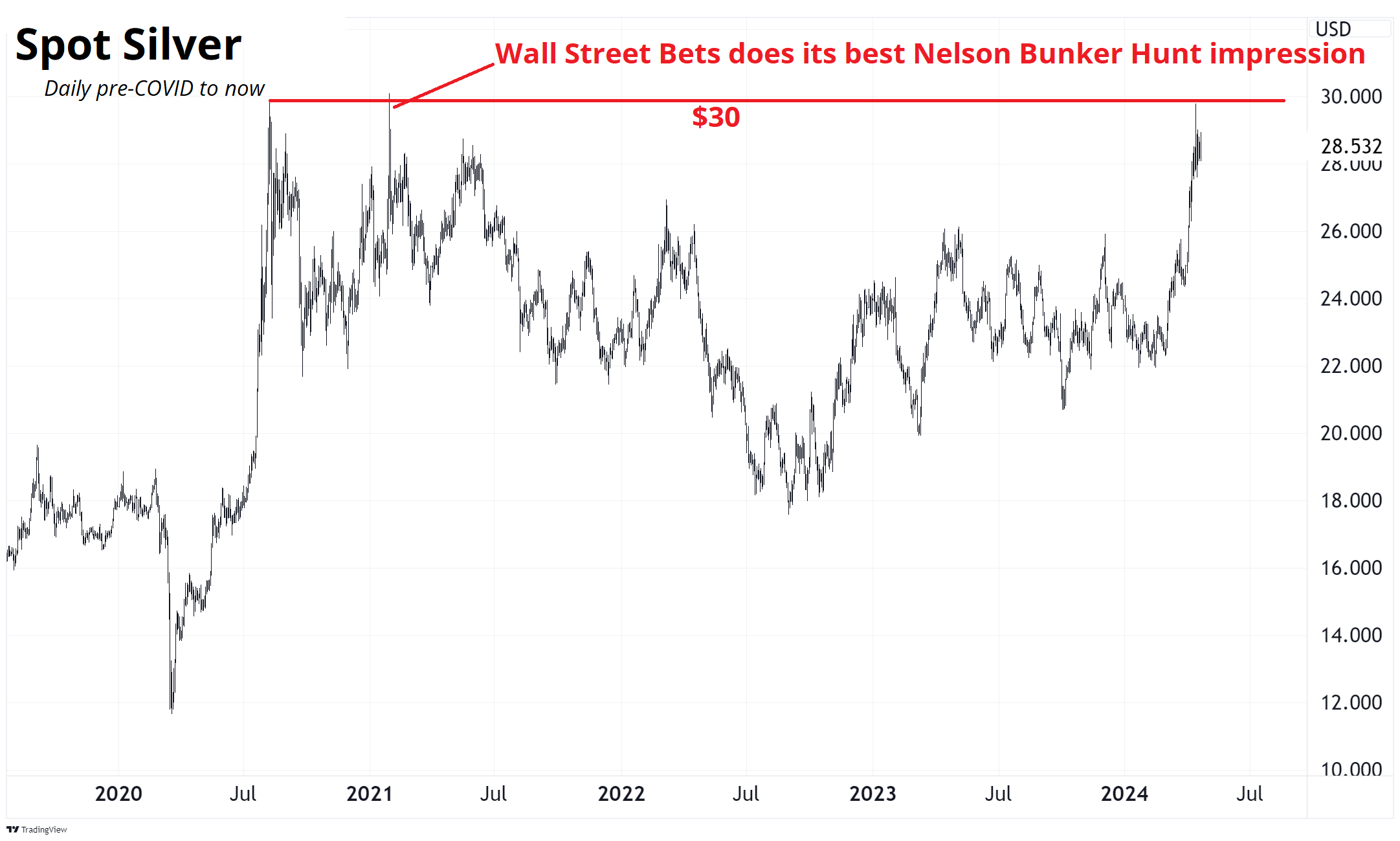

At the height of the Reddit Wall Street Bets phenomenon, the apes tried to do to silver what they had done to GameStop and AMC. It failed miserably. In a situation a tiny bit reminiscent of the Hunt Brothers’ failed attempt to corner the silver market in 1980.

That foray into silver took the metal up to $30 and then it dumped almost 50% in the period that followed. That level remains front and center the most important level for XAG. Here’s the chart:

Something to watch as risky assets sag.

Finally, if you want to read an in depth piece that I wrote about the acute shortage of safe assets in the market today, check this out. It’s free.

https://www.spectramarkets.com/amfx/acute-shortage-of-safe-assets/

OK! That was 7.94 minutes. Please share this with any aspiring finance professionals that you know! Thanks!

Get rich or have fun trying.

Links of the week

Join the waitlist for Spectra School. Let’s go! Improve your thinking and learn the right frameworks for trading and investing. The stuff you don’t learn in college. https://www.spectramarkets.com/school/

Smart, interesting, or funny

- Understanding the Math of Consciousness

A one-hour listen for the more philosophical peeps out there.

- Did you know Mozzarella di Bufala, unlike Buffalo Wings, actually comes from Buffaloes? Water buffaloes. How did I not know this?

- Cool excerpt from “In Cold Blood” by Truman Capote:

“You exist in a half-world suspended between two superstructures, one self-expression and the other self-destruction. You are strong, but there is a flaw in your strength, and unless you learn to control it the flaw will prove stronger than your strength and defeat you. The flaw? Explosive emotional reaction out of all proportion to the occasion. Why? Why this unreasonable anger at the sight of others who are happy or content, this growing contempt for people and the desire to hurt them?

All right, you think they’re fools, you despise them because their morals, their happiness is the source of your frustration and resentment. But these are dreadful enemies you carry within yourself—in time destructive as bullets. Mercifully, a bullet kills its victim. This other bacteria, permitted to age, does not kill a man but leaves in its wake the hulk of a creature torn and twisted; there is still fire within his being but it is kept alive by casting upon it faggots of scorn and hate.

He may successfully accumulate, but he does not accumulate success, for he is his own enemy and is kept from truly enjoying his achievements.”

Music

Sublime was an incredibly influential band for a short period in the 1990s, but their lead singer, Brad Nowell, died of an overdose right before their most popular album came out. He left behind a son.

Well, that son is grown up now. And he’s the new lead singer of Sublime, joining the old band members. It’s like a movie script come to life.

Watch Jakob Nowell sing Santeria here.

Rolling Stone article about him here.

The picture of the dad with guitar and small kid is so iconic. Here’s mine.