Technical Analysis – Is AUDUSD set for a break higher?

AUDUSD sends some encouraging signals

But the bulls need to claim the 0.6600 territory

US nonfarm payrolls awaited at 13:30 GMT

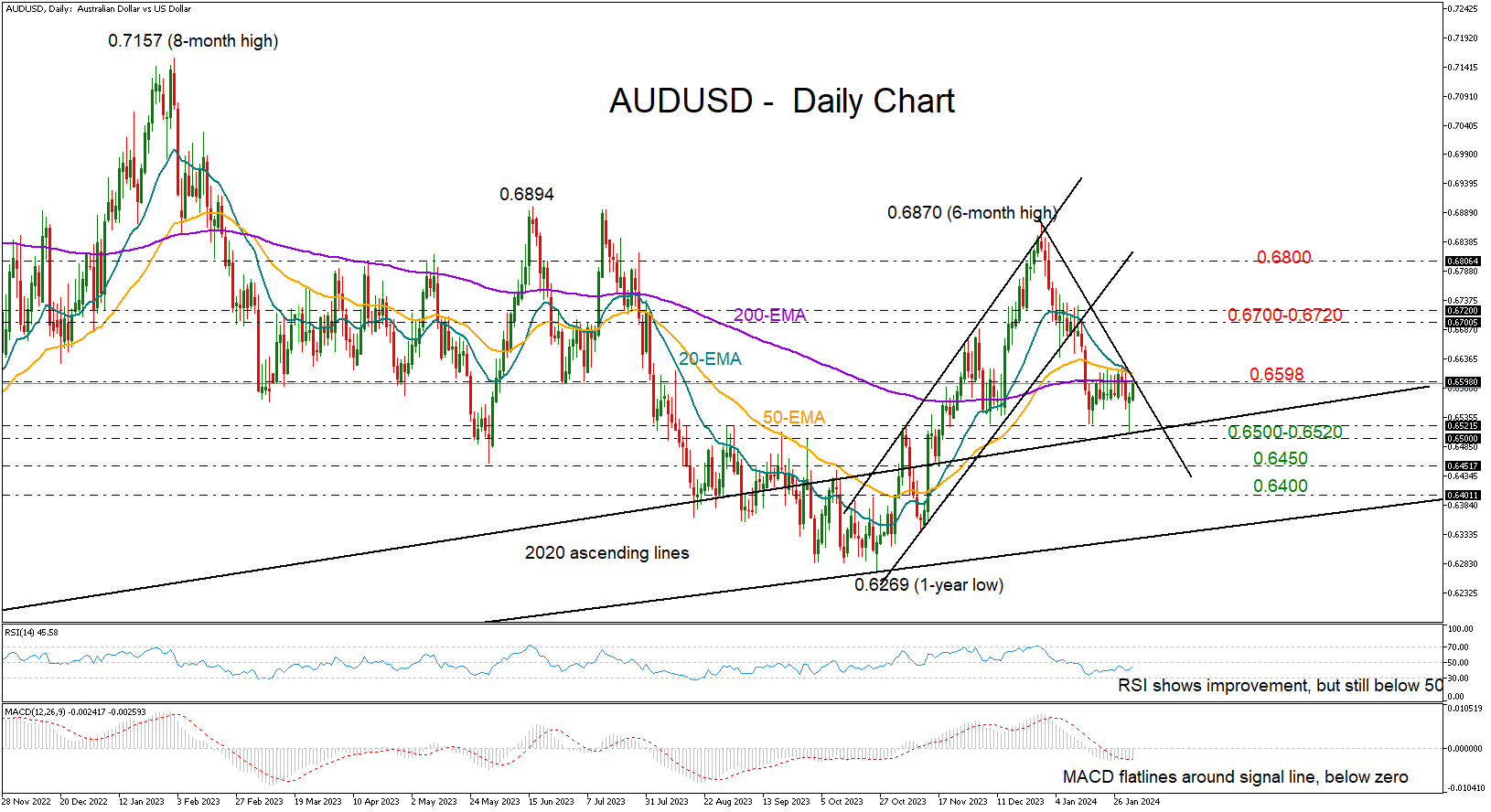

AUDUSD bulls came into action instantly after the price dropped to a more-than-two-month low of 0.6507 to test the ascending trendline from the 2020 low. The pair finished the day with a bullish long-tailed hammer candlestick, which is theoretically a positive signal of an upside reversal. Yet, traders will need another big green candlestick to confirm a continuation higher.

The exponential moving averages (EMAs) have been capping upside movements around the 0.6598 level over the past week. Therefore, a clear break above this wall is probably required for a rally towards the next resistance of 0.6700-0.6720. Even higher, the pair could retest the lower band of the broken bullish channel near the 0.6800 psychological mark.

Note that the RSI has yet to rise above its 50 neutral mark, while the MACD remains stable near its red signal line, reflecting some uncertainty in the market.

If the pair gets a rejection near the 0.6600 number, the focus will turn back to the 0.6500-0.6520 constraining zone. A close below this region could trigger a decline towards the 0.6450 area, where the pair paused several times in the second half of 2023. The 0.6400 round level could be the next destination if sellers stay in play.

All in all, AUDUSD is displaying a bullish tendency, with traders likely awaiting a durable move above the 0.6600 mark to boost the price higher.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.