- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Forex

- FX Analysis – Yields and Dollar drop ahead of NFP , AUD and NZD outperform, JPY traders watching the 150 level

- Home

- News & Analysis

- Forex

- FX Analysis – Yields and Dollar drop ahead of NFP , AUD and NZD outperform, JPY traders watching the 150 level

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Yields and Dollar drop ahead of NFP , AUD and NZD outperform, JPY traders watching the 150 level

6 October 2023 By Lachlan MeakinThe USD sell off continued Thursday moving in lockstep with yields again ahead of today’s key non-farm payroll figure. Unemployment claims came inline and had a limited impact as it was yields driving action in the USD. DXY dropped to close at the lows of 106.32 from earlier highs of 106.86. So far this looks like a technical pullback from overbought levels, with a strong support at the lower trendline around 106.10 as traders turn to watch todays NFP figure.

EUR was propped up once again by USD weakness, with EURUSD testing the key support at 1.05 several times before rallying to hit a high of 1.0558. ECB members de Guindos and Kazimir spoke, with the former saying the current level of rates will help tame inflation, but noted the ECB is data dependent and it is premature to discuss rate cuts. While Kazimir noted that the September EZ core inflation confirmed ECB expectations, and reiterated he believes the last rate hike was the final one.

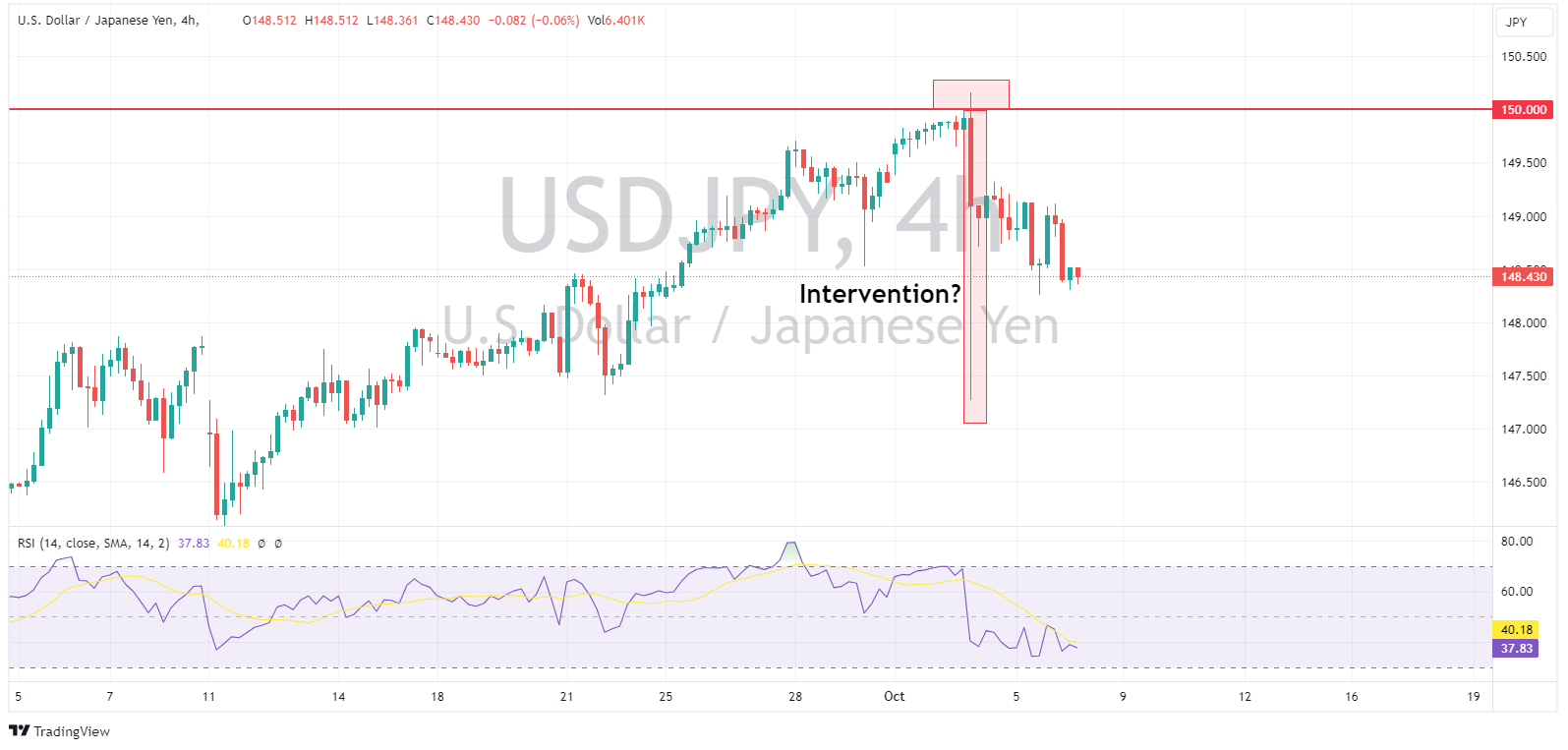

JPY firmed against the USD with USDJPY dropping below 149.00 led by the softening of US Treasury yields. Traders seemingly still wary of a push above 150.00 seeing potential Yen intervention following the “flash crash” on Tuesday when the pair poked above this level.

AUD and NZD were bid with outperformance in both currencies, bolstered by the improved risk sentiment and lower US yields. AUDUSD rose above 0.6350 and NZDUSD rose above 0.5950, the Kiwi marginally outperforming the Aussie seeing the AUDNZD cross rate drop below 1.07 again, the pair has found some short-term resistance at the 1.07 level this week with cross make a few attempts to break and hold but so far being rejected.

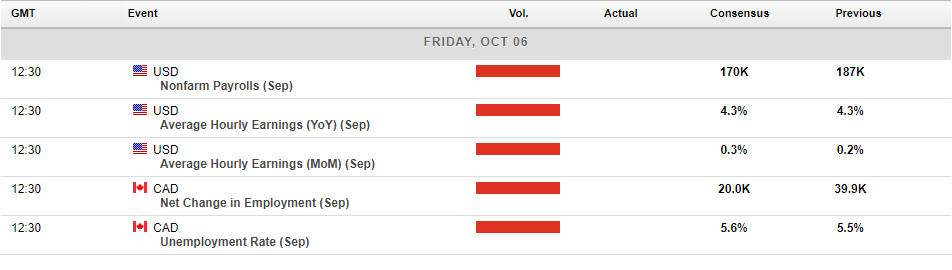

Today’s calendar is dominated by the always exciting NFP, a hot figure here will test the markets pricing of interest rates and should see the yield/USD rally recommence.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Charts to watch this week – Gold and Oil gap up on Mid-East turmoil, US Dollar

Gold and Oil have unsurprisingly gapped higher on Mondays open after the weekend’s hostilities in the Middle East, Gold reclaiming it’s safe haven status and Oil opening 2% higher on supply problems from fears of a protracted and escalating conflict. Geo-political events are looking to dominate the market narrative this week, though key US i...

October 9, 2023Read More >Previous Article

FX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

The first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps ...

October 4, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.

- Trading