Technical Analysis – EURJPY flirts with summer highs

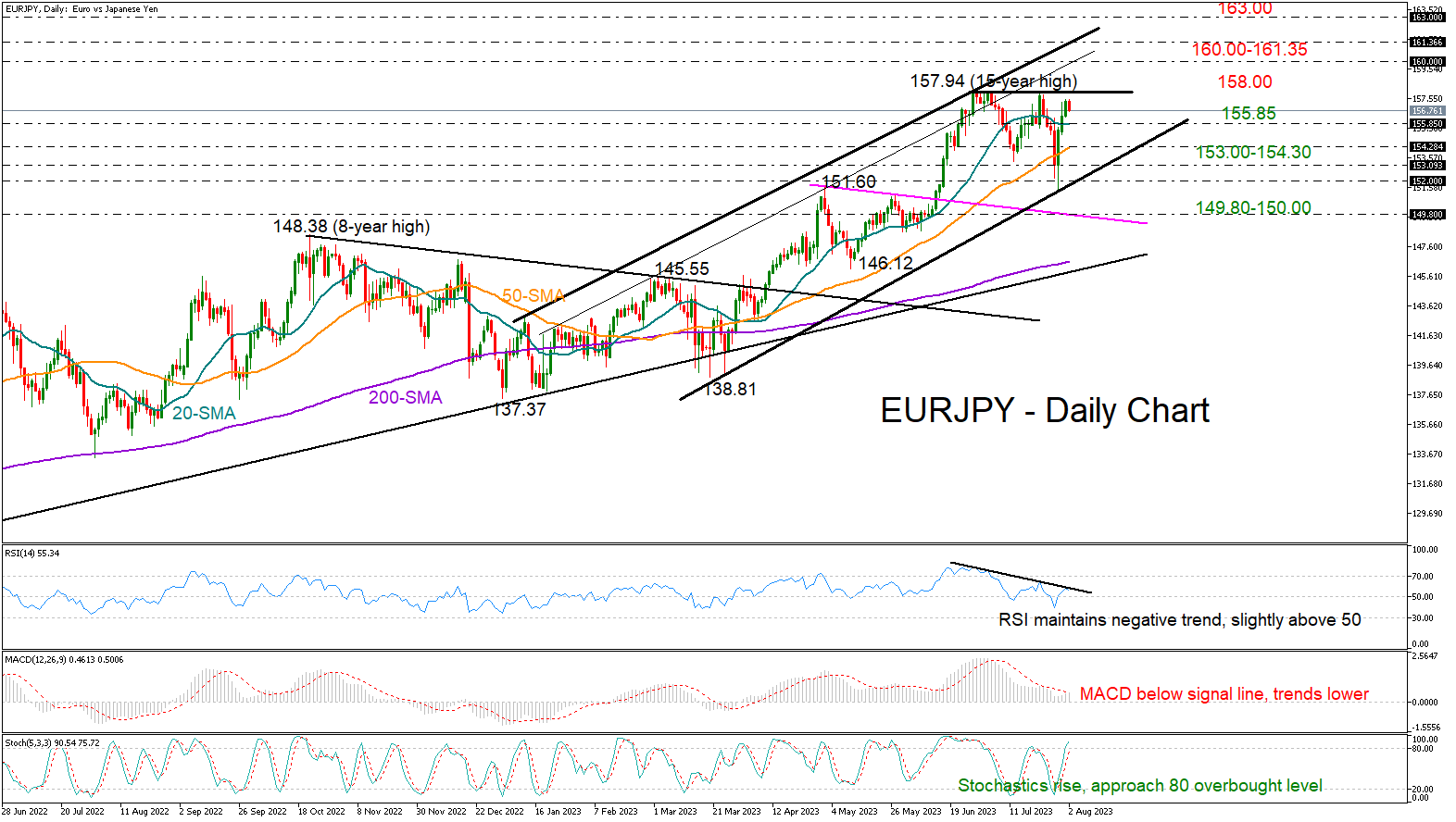

EURJPY is flirting with its 15-year high of 157.94 again that it registered in July, thanks to strong buying interest over the past three days.

The pair bounced up with strong momentum following the nosedive to a six-week low of 151.39 last Friday, forming a bullish channel in the medium-term picture. More fuel is needed to continue the rally above 158.00, but the negative trend in the RSI and MACD cast doubt on a major change happening soon. Note that the stochastic oscillator is nearing its 80 overbought level too.

If the uptrend resumes above 158.00, the price could mark a new higher high somewhere between 160.00 and 161.35, where the two resistance lines from January could cap the price. Another successful battle there could lift the price towards the 163.00 barrier last seen in August 2008, while a faster increase could target the limits around 165.00.

Looking for support levels, the 20-day simple moving average (SMA) has been limiting both upside and downside movements occasionally in the past and could immediately come into consideration at 155.85 if sellers take control. The space between the 50-day SMA and the 153.00 round level might delay a test near the channel’s lower boundary seen at 152.00. Even lower, the pair might seek shelter within the 150.00-149.80 constraining zone.

In brief, despite the quick recovery from last week’s plunge, EURJPY has not eliminated downside risks yet. An obvious extension above 158.00 is essential for a continuation towards 160.00.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.