So, the FOMC day has arrived. The market has already priced in one rate hike (according to futures, with a 99% chance), and judging by the recent bullish rebound of the dollar, it doubts that the regulator will consider the June deceleration of core inflation as a starting point in its communication. The Fed could either discount the positive inflation developments or announce that the future policy will be entirely data-dependent, which would be a strong bearish signal. In the first case, the dollar may not only sustain its growth at the beginning of this week but also gain some more ground (EURUSD may drop below 1.10). In the second case, it is expected that sellers will target levels below 100 in the DXY index, and EURUSD will return to considering a rally towards the multi-year resistance at 1.15.

Here's one of the technical setups for the Dollar index:

The movements of major currencies in relation to each other in recent days exposed several intriguing trends. Optimism about China's economy has strengthened, which also manifested in the successful resistance of export-dependent currencies (CAD, AUD, NOK) to the moderate dollar recovery. The Brazilian real and the South African rand also appreciated due to the strengthening of the Chinese currency, which have a significant positive correlation with renminbi. A slight negative reassessment of growth prospects for the EU (after the ECB's bank lending survey and PMI activity indices) resulted in a 1.3% correction of the European currency against the dollar, which had a very steep ascent last week. The British pound is also struggling with growth ideas due to the shock caused by inflation figures for June.

The main short-term drivers in the currency market will be the Fed communication today, the ECB meeting on Thursday, as well as the story with fiscal and monetary stimulus in China, which urgently needs to return the economy to its targeted growth trajectory. As for the Fed, despite significant inflation progress, the regulator is unlikely to shed the mantra in its accompanying statement that further policy tightening "may be appropriate." It is also worth paying attention to the potential reaction of the regulator regarding market expectations for the rate next year, which currently account for a 100 basis point rate cut. Overall, in my view, the Fed meeting will have positive consequences for the American currency, especially if we assume that the market showed an excessive reaction to the CPI report, after which the greenback depreciated by nearly 3%.

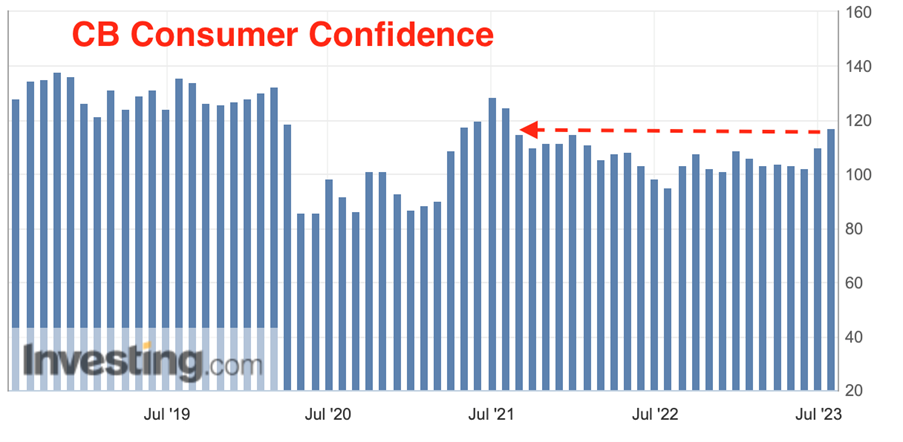

It is also worth noting the positive release of the Consumer Confidence report by the Conference Board yesterday. The index surged from 110 to 117 points, the highest level since July 2021:

Against the backdrop of solid labor market statistics, the still healthy rate of US consumer spending, and optimism among American households, one cannot ignore the risk of a repeat acceleration of inflation or "sticking" near current levels, and the regulator is likely to take this risk into account in today's decision.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.