These questions were sent to me by a very intelligent, hard working, professional trader. She agreed to let me share them with my blog readers. I think some readers may find value in the answers based on my own journey and learning the hard way.

These questions were sent to me by a very intelligent, hard working, professional trader. She agreed to let me share them with my blog readers. I think some readers may find value in the answers based on my own journey and learning the hard way.

1. On your weekly puts from Thursday January 3rd, only AAPL was below the 50 SMA on a daily chart. NFLX and PCLN were above 50 and 10 SMAs. Were your entries based on intraday MAs/charts, ex. a 60-min? What were your specific entry criteria, please? I bought AAPL puts based on two reversal candlesticks in a row pointing towards distribution, I bought PCLN puts based on a violent rejection above the 200 day and a loss of the 200 day, I bought NFLX puts based on a failed break out to near term highs. These were all bought at the time based on so many candlestick reversals across many charts that day and a needed slight correction to near term support in the indexes. The AAPL put was a big winner, PCLN a small loser, and NFLX an almost complete loss. I made over $2,000 that day, all winning traders really need is one really big win out of every three trades to make money.

2. Are your charts setup exactly like in your “2 mil” book? Daily candlesticks, 50 SMA, 10 SMA or 5 EMA, RSI and MACD? Do you use volume at all? Do you use specific RSI or MACD signals? I use the trend trading systems in my Darvas 21st century book for trending markets and stocks, that is only one of my methodologies, I also use candlestick signals for very short term trades, and option strangles in volatile markets. Some of the art of trading comes from knowing how to capture different trends based on different types of chart action in different market environments. At least for me it is because I am a rule based discretionary trader.

3. Do you use anything other than charts, specifically any order-flow software or other professional tools? I hear many Twitter traders talking about “seeing” order blocks go through. Value or just “noise”? My trading only requires daily charts and intra-day price range, sometimes volume is also informative. I believe big blocks are just noise in my opinion. They could be buying or selling for many reasons, but daily ranges tell a story.

4. Do you ever use on-balance volume? Acc/distr.? Stochastic? $NYMO/McClellan? Fundamentals? Other indicators? My primary technical indicators are price, moving averages, sometimes volume, and I do prefer CAN SLIM fundamental criteria for my stocks, historically these are the stocks that can really go parabolic and trade in trends in both directions. I have not found value in indicators that are derivatives of price action. Technical indicators that are measuring over bought/over sold are worthless in trending markets and that is where I make my biggest profits.

5. Do you ever use intraday (ex. 20-d/60-min) charts or only eod action/daily charts? Ever use weekly/monthly charts? I do at times look at intra-day charts for entries and exits but my concern is primarily with the daily trading range for each day and the trend on the daily chart. For my trading time frame the weeklies are not really useful.

6. I wish to avoid “noise”, one of my weaknesses. Do you ever follow peripheral charts, such as Indices, $VIX, TLT, USD strength/FX, JJC/Copper, $DJCHINA, Baltic Dry Index, IBD Market Pulse, etc. or do you strictly follow only the stock’s chart? I do look at he VIX, but I follow the stock index ETF charts SPY, DIA and QQQ to understand the overall stock market trend. Ultimately my decisions are based primarily on the stock’s chart action and its price action around the 5 day ema.

7. I know you don’t hold over earnings. Do you ever pay attention to general market news (ex. fiscal cliff, etc.)? FOMC day? NFP day? Or do you only study price action? I do trade more cautiously with over hanging headline risk. But I will only trade based on price action confirmation. I believed the Republicans had no choice but to make a deal during the fiscal cliff silliness but was only able to go long after the market rallied leading into the news.

8. In your accounts, are you only doing the trades you post on Twitter or do you have other long-term trades, ex. a growth stock or dividend stock that just “sits” and doesn’t require a lot of hand-holding? Or, like Dan Zanger has, REITs that “sit” and pay out dividends? I do have a pretty large six figure tax deferred retirement account where I trend trade the S&P 500 index using mutual funds during bull markets in addition to my actively traded account I post on twitter. I do not go short in this larger account and I use the same moving averages to trade it.

9. Related to above, are you only doing asymmetric weekly options now? No more monthly options like in “2 mil” book? Any stocks/LEAPs/REITs, etc? I have evolved to only doing weekly options almost exclusively for their built in asymmetry and huge risk reward dynamics. I may still in the future do some small stock trades in special situations if the options are not liquid enough, I did this in the 4th quarter with MNST with good results, but I am a weekly option trader first.

10. Saw your posted 1% risk video. Are those also your personal criteria, ie. 1% of total trading capital (not just options account capital) per trade, with a total of 3% risk at one time. Yes, I try to only risk 1% of total trading capital on any one trade and never expose more than 3% at risk at any time. It is amazing that whip saws and volatility expansion can push me to 2% loss a few times a year. It just shows it is dangerous to trade too big. I love to buy options that only cost 1% of my trading capital to totally eliminate any risk of whip saw or greater losses.

11. Do you take any months off during year, ex. summer/August? Do you attend any seminars/trade shows? You mentioned Covel podcast. Any radio shows/podcasts on a regular basis? Any subscription services? No, I do not take off any specific time when the markets are open. I will take off three days in a row or more if I see no advantage in an entry. But even in volatile choppy markets I love to play cheap weekly strangles on Thursday and Friday. I have never attended a trade show or seminar, if I did it would be Dan Zangers. I listen to Michael Covel podcasts on a regular basis. I do not subscribe to any services, but if I did it would be Dan Zanger’s letter or the Darvas Pro Newsletter.

12. I believe you use IBD 50 (Monday edition?) but I don’t usually see you trading those leading stocks. How do you use IBD? Do you follow their Market Calls? Last year my big IBD 50 finds were Apple and PCLN in the 1st quarter they paid for my subscription. Also GOOG and EBAY entered the IBD after I was already trading them for a few weeks. I am an option trader so I need liquid options to trade so I trade the bigger cap IBD stocks. I still subscribe to the IBD Monday edition and look at the list each week. In a truly bullish market this list will be crucial 2009-2012 has primarlily been a chop and slop with small windows of opportunity. IBD is really an investment system and I am a trader. I use many of their principles and think it is the place to start for anyone wanting to understand how to make money in the stock market.

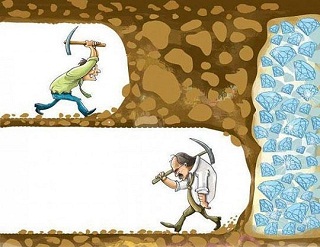

13. I’ve been trading for six years without a profitable year (I’ve had winning streaks then given it back). How many years did it take you to become profitable? What training did you have or are you self-taught? When is it time to face reality and give up on the trading dream or do we never give up? Am I on the long side of how long it takes to “get it” or is six years about average? Unfortunately I was successful right out of the gate buying tech mutual funds in the late nineties and swing trading them. I had enough money to pay off my first house when I was 27 years old. I thought I was a genius, I was greatly humbled with a 50% draw down by 2002, that lesson really taught me the rule of taking profits while they were there and motivated me to study price action, follow trends, and educate myself. After 2002 I did not have any real losing years just smaller returns. My lessons in the year 2000 gave me the motivation to go to primarily cash in January 2008 in my investment account and keep all my bull market profits from 2003-2007. I think a trader can expect up to five years to become profitable.

The time to success will be determined by the focus on what really makes money and the avoidance of what does not matter in my opinion.

The market personally taught me what works and what does not but the 300 trading/investment books I read were the keys to my current success.

It is time to give up on trading completely when you hate it, you have to love trading and the markets it is not worth the trouble just for the eventual money because anyone with common sense would quit before they were profitable due to the pain to get to profitability. If it is hurting your family or hurting your ability to provide for your family it is time to go part time in your trading and restore balance to your life. But real traders never quit, they love it too much, they can’t quit because that is just what traders do, they trade.The only thing that separates the passionate and dedicated trader from trading success is time.