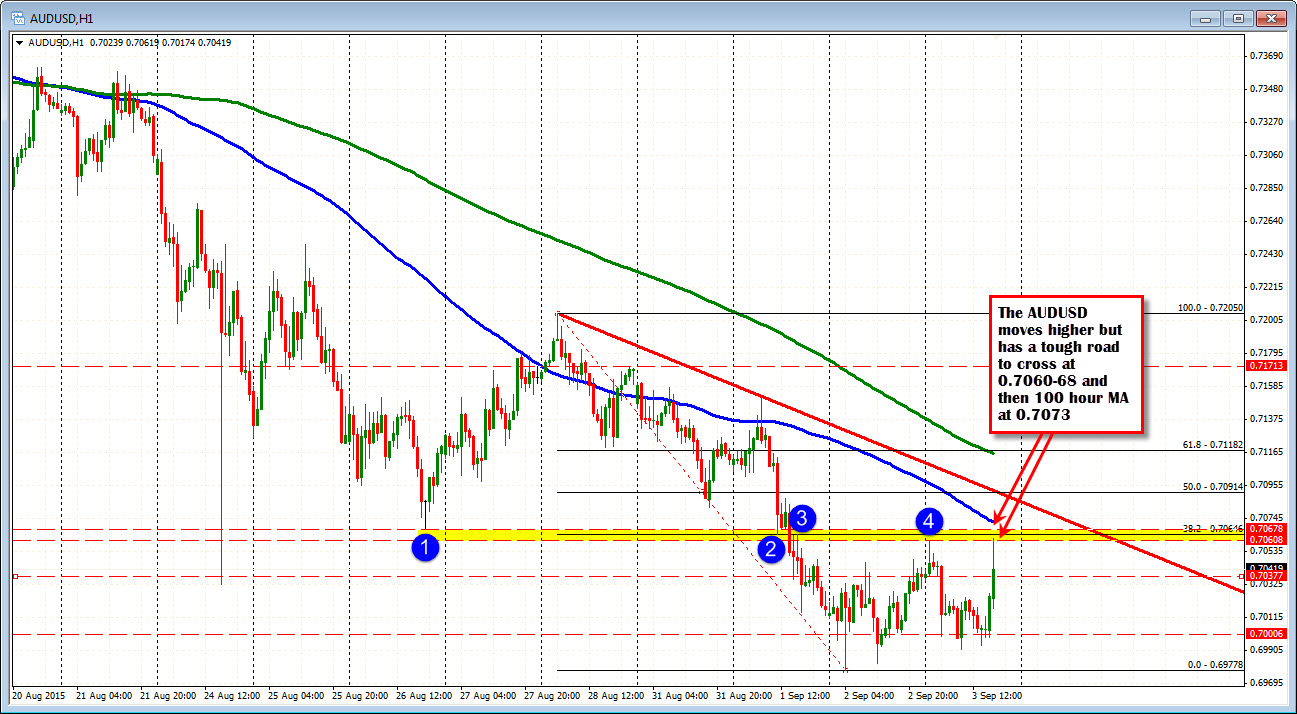

...runs into floor/ceiling area and 100 hour MA and rotates toward intraday support

The AUDUSD is another commodity currency which saw better buying in the NY session. Commodities are higher on the day and technicals have helped contribute. However, the pair has run into some topside resistance which has slowed the rise.

Looking at the hourly chart, the move higher based in the New York session near the 0.7000 level. The low in the London morning session came in at 0.6994. Yesterday, the price fell to the lowest level since April 2009 (low extended to 0.69778), but later in the day recovered back above that 0.7000 level and corrected higher.

The high today stalled near the high price from earlier in the Asia-Pacific session. This is also near low levels from August 26 in September 1 ( see blue circles in the chart above). This area - between 0.7060 and 0.7068 – is proving to be a tough road to cross. In addition, the 100 hour moving average, which is currently at 0.7073 (and falling) is another obstacle for the bulls to get through.

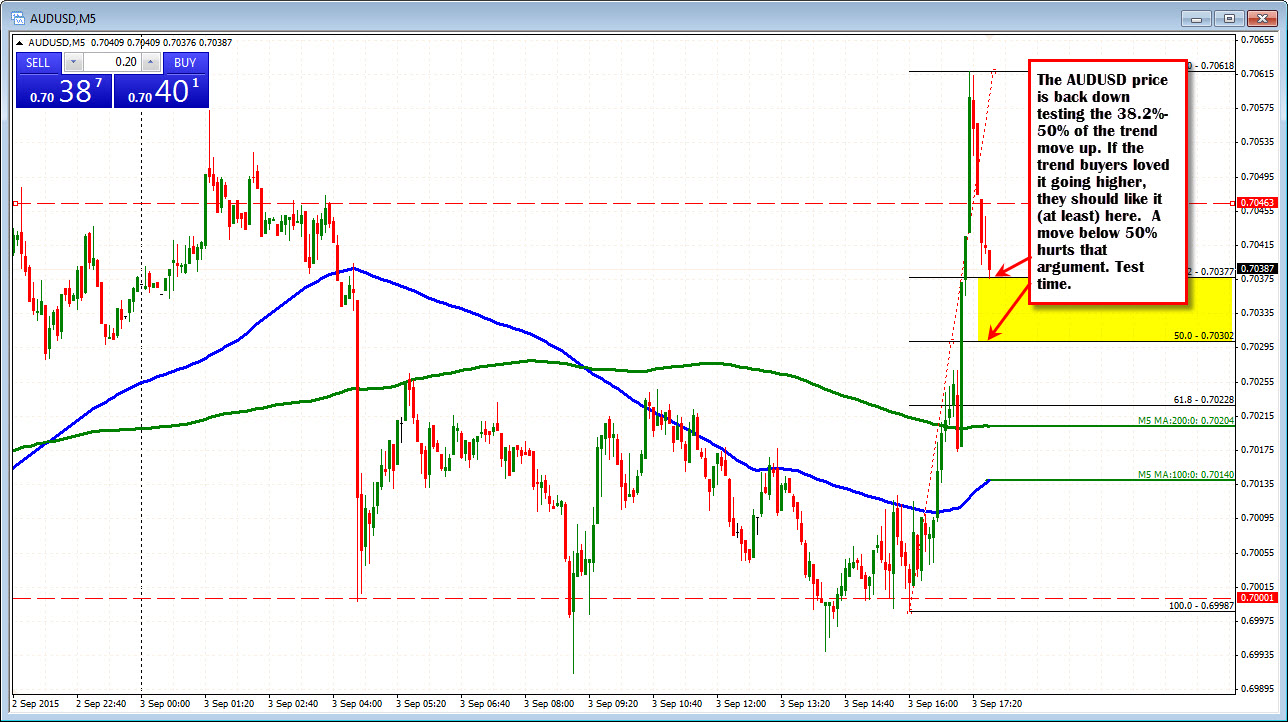

The price is down testing the 38.2% -50% of the trend move higher. If the trend buyers today . love it on the way to the upside, they should at least like it in this area at 38.2-50% off. A move below the 50% will muddy that water though. Technically a test for the pair.