From a sleepy currency pair, dollar/yen turned into an unstoppable mover. Will it consolidate or continue rallying? Retail sales and household spending are the major events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Japan’s yearly trade deficit hit a record high of 1.48 trillion yen, posing a major risk to the Japanese economy while Adjusted Merchandise Trade Balance showed a deficit of 612.8 billion yen, beating predictions of 847.8 billion yen deficit. Nevertheless these readings are worrisome for Japan indicating recovery is a long way off.

Updates: Dollar/yen continues to move upwards, climbing to an eight-month high of 81.49 in early trading. Higher US yields are supporting the pair, so look for the pair to continue to push higher as dollar/yen gets comfortable above 80. US Fed Chairman Bernanke will be testifying later in the week, which could stir up the money markets. USD/JPY managed to climb above 80.50 after the falls. Some bad US figures weakened the pair. Dollar/yen was up over 400 pips in February, closing the month at 86.50. Retail sales dropped to 1.9%, but were still well above the market forecast. USD/JPY broke above 81, as the dollar strengthened following US Fed Chairman Benanke’s testimony.

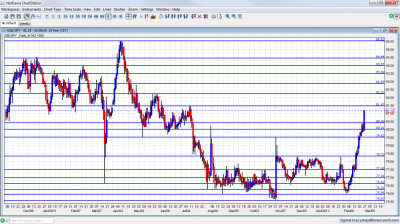

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Retail Sales: Monday, 23:50. Retail sales in Japan soared 2.5% in December from a year earlier; the highest climb in more than a year, following 2.2% decline in the previous month. Food and clothing were gave the major boost to sales. However Core sales excluding food dropped 0.1% in December. The global uncertainty weighs on Japan’s economy by strengthening deflation. A flat reading is expected now.

- Prelim Industrial Production: Tuesday, 23:50. Industrial production in Japan edged up 4.0% in December suggesting a recovery process following the devastating earthquake and tsunami on March. The reading was well above the 2.8% rise expected. A rise of 1.6% rise is expected.

- Housing Starts: Wednesday, 5:00. Housing starts in Japan plunged 7.3% in December from a year earlier amid lower housing investments in light of the global slowdown. This decline was much lower than the 1.4% drop anticipated. A further decline of -3.1% is forecasted now.

- Capital Spending: Wednesday, 23:50. Capital spending tumbled in the third quarter sliding 9.8% from the same period last year. The drop can be contributed to Japan’s fragile economic position hindering investments and corporate spending. The drop was bigger than the 7.8% decline registered in the second quarter immediately after the earthquake. This negative reading may dray further intervention from the BOJ. Another fall of 6.4% is predicted.

- Household Spending: Thursday, 23:30. Japanese household spending increased 0.5% in December from a year earlier following 3.2% decline in the previous month. However economic uncertainty and slow wage growth will continue weigh on consumer spending. A drop of 0.7% is expected this time.

- Tokyo Core CPI: Thursday, 23:30. Core consumer prices in Tokyo dropped 0.4% in January from a year earlier, following a 0.3% decline in December a bit more than the 0.3% decrease anticipated. Meantime Japan’s core consumer prices fell 0.1% suggesting deflation is continuing in face of the strong yen and global slowdown. Another 0.4% drop is predicted.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen started the week with a struggle around the 79.50 line. After crossing 80, it was capped under 80.50 (a new line that didn’t appear last week), before surging and closing at 81.18.

Technical lines from top to bottom

85.50 is still far, but after the recent surge, we can already look at it. This was a peak after a strong move in March 2011. It held for more than one day. 84.50 capped the pair at the end of 2010 and at the beginning of 2011 and is also an important line.

Another significant line of resistance is found at 84, which capped the pair back in February 2011. It is closely followed by minor resistance at 83.50.

82.87 was the line where the BOJ intervened in September 2010, and also worked in both directions afterwards. 82.20 was a stubborn peak in May 2012 and is now the highest line.

81.50 was a clear line of resistance that marked the big fall in the summer. 80.50 temporarily capped the pair in the surge of February 2012, and also worked as support in the summer of 2011.

The round number of 80, which provided strong support in June, is the next line, and it is of high importance. 79.50, is now a battleground. This is the line that was reached after the last non-stealth intervention.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. After it was broken, the rally intensified. It now switches to support. 77.50 is weaker now. It worked well also in October and the surge in February 2012 didn’t provide a clear break.

The round number of 77, is a significant cap once again and was only temporarily breached. It’s followed closely by 76.60 which was a significant line of support at the beginning of 2012. Once it was broken to the downside, any attempts to move higher will be capped by this level.

Further below we have the swing record low of 76.25 which is more of a pivotal line at the moment. A previous low of 75.95 is now stronger support. It kept the pair from falling to lower ground.

I am neutral on USD/JPY.

With Greece getting to close to a breaking point, demand for the Japanese safe haven, even if not really safe, could emerge. This could temporarily stop the pair and allow for some consolidation. The long term direction remains higher, especially as Japan suffers from trade deficits and the US continues improving. Also rising US yields support the greenback.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealanddollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.