EUR/USD enjoyed another week of gains during the holiday week, but could not sustain them, as the US is approaching the fiscal cliff. As a new year begins, volume and volatility are expected to rise. Manufacturing and service PMIs and employment figures are the highlights of this week. Here is an outlook on the main market-movers this week.

In the US, politicians are working extraordinary hours, but there is still no deal in sight. A temporary solution could be reached to avert the cliff but keep the issue active. In Europe, French consumer spending, edged up 0.2% in November, but retail PMIs show weakness across the continent during this holiday season, also in Germany. Where are Europe and the euro headed?

Updates: German Prelim CPI climbed 0.9%, beating the forecast of 0.9%. Spanish Manufacturing PMI came in at 44.6 points, just below the estimate of 44.9. Italian Manufacturing PMI looked good, posting a reading of 46.7 points. This was well above the estimate of 45.4 points. Final Manufacturing PMI came in at 46.1 points, just below the forecast of 46.3. Spanish Unemployment Change was outstanding, as claims fell by 59.1 thousand. The markets had predicted a gain of 50.3K. German Unemployment Change also was positive, with just three thousand new claims. The estimate stood at 11K. Eurozone M3 Money Supply climbed 3.8%, matching the forecast. Private Loans declined by 0.8%, weaker than the estimate of a 0.5% drop. The French 10-year Bond Auction posted an average yield of 2.07%. The euro continues to plunge, and has fallen below the 1.31 line. EUR/USD was trading at 1.3093.

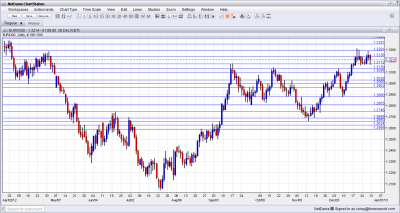

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Prelim CPI: Wednesday. German preliminary CPI declined in November, from a month ago, following a flat reading in October. The reading was in line with predictions. From a year earlier, CPI growth eased as expected to 1.9% from 2.0%. A rise of 0.7% is expected now.

- Manufacturing PMIs: Wednesday. A sign of hope for the euro-zone as manufacturing PMI rose to 46.2 in November from 45.4 in October. Although it is still below the 50 point line but the decline in factory activity, new orders and output has eased due to a renewed revival in markets such as the U.S. and Asia. Meanwhile Spanish manufacturing PMI also increased, rising by 2 points to 45.3 in November but Italy disappointed with a decline to 45.1 from 45.5 in October contrary to predictions for a 45.9 reading. Factory production in Italy slowed further for the fourteenth straight month in November, with the pace of decline accelerating to the fastest since August. Spanish manufacturing PMI expected 44.9, Italian manufacturing PMI 45.4, Final Manufacturing PMI, 46.3.

- Spanish employment data: Thursday, 8:00. Spanish jobless claims have not improved in November rising by 74,296 after a 128,200 increase in October. Although the reading was lower than the 90,000 expected, the figure is 15,000 higher than the same month a year ago. Spain’s jobless claims are close to 6 million, more than 25% of Spain’s total workforce. Another addition of 50,300 jobless claims is expected now.

- German unemployment change: Thursday, 8:55. Germany’s labor market printed a small rise of 5,000 jobless claims in November. The reading was well below the 15,000 predicted raising hopes that private consumption will boost German economy. An addition of 11,000 is expected this time.

- M3 Money Supply: Thursday, 9:00. Annual growth in domestic currency edged up in the euro zone by 3.9% far more than expected , however loans to companies and households still contracted. Loans to the private sector declined 0.7% from the same month a year ago. A rise of 3.8% is forecasted now.

- German Retail Sales: Friday, 7:00. Retail sales in Germany dropped more than expected in October, down 2.8% after a 0.4% decline in the previous month, indicating that domestic spending cannot compensate for the country’s declining exports and the ongoing EU crisis. A rise of 0.9% is expected now.

- Service PMIs: Friday. The euro zone’s economic downturn eased slightly in November with a rise to 46.7 from 45.7 in October, amid stronger growth in the U.S. service sector indicating renewed hope for global markets. Meanwhile Spain and Italy continued to contract; Spain rose slightly to 42.4 from 41.2 still was below the 50 point line and Italy dropping to 44.6 from 46.0 in October. Expectations are: Spanish Services PMI – 42.7, Italian Services PMI-45.1, Final Services PMI-47.8.

- CPI Flash Estimate: Friday, 10:00. The flash inflation estimate for the eurozone declined to 2.2% in November vs. 2.5% in the previous month, below the 2.4% forecasted. The main contributor for this decline was a decline in energy prices. A further decline to 2.1% is forecasted.

*All times are GMT.

EUR/USD Technical Analysis

€/$ started the week by stabilizing over 1.3170. The pair then made a move higher, but was capped by the 1.3290 line (mentioned last week) before closing at 1.3214, a small gain from the previous week.

Technical lines from top to bottom:

In the distance, 1.36 was a cushion in the fall of 2011 and then switched to resistance. 1.3480 was the peak seen in February and provides a significant backstop to 1.340.

1.34 was a stubborn cap during the spring of 2012 and is the far line in the distance. The next stepping stone is at 1.3350, which worked as a pivotal line in the past.

Below, 1.3290 served as resistance before the pair collapsed in May, and despite a small breakout in December, the line remains intact – a second attempt to break higher was already fully capped. 1.3240 is now a pivotal line in the middle of December’s high range. It separated trading zones more than once in December.

1.3170, which was the peak of September, served as support for the pair after the break in December and is a key line on the downside. 1.3130 proved to be strong resistance during December 2012 and now switches positions to support.

1.3110 is a minor line after working as temporary resistance in December 2012. 1.3030 provided some support at the same period of time, and also at the end of November 2012. Both are minor in comparison with the next line.

The very round 1.30 line was a tough line of resistance for the September rally. In addition to being a round number, it also served as strong support. It recently worked as a battleground and the pair is now ready for another battle around this line. It is closely followed by 1.2960 which provided some support at the beginning of the year and also in September and October – the line is strengthening once again after temporarily cushioning the fall during December.

1.2880 provided some support in October and also in late November and December. It proved to be a backstop on the initial false rally after Obama’s victory. 1.28 is the bottom border of the range, and was eventually left behind. The pair fell to this low in September and later got close to it.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is now a pivotal line in the range. 1.2690 was the new low after the November breakdown, and also provided support on a second downfall attempt in November 2012.

1.2624 was the low in January and now serves as weak support,1.2590 was a cap during August, before the pair surged.

Below, the round number of 1.25 is not only of high psychological significance (USD/EUR 0.80) but also worked as support during the summer of 2012. 1.2440 is already a stronger line, that was a clear separator during August.

I remain bullish on EUR/USD

There is a good chance that politicians in the US will reach some kind of agreement on the fiscal cliff. Even an agreement for two or three months would satisfy markets for now, and this could boost the euro Also the many positive signs from the US certainly help the “risk on” environment – dollar selling, as seen throughout most of the post financial crisis period.

On the other hand, Europe