Today’s U.S. jobs report was a bit of a mixed bag which will enable people to take away from it whatever suits their agenda. The headline Non-Farm Payrolls number will always hog the spotlight immediately following the release and the disappointment here, combined with slight downward revisions for February and March, sent the U.S. dollar lower initially. The dollar has since recovered to trade back at pre-release levels which suggests markets aren’t as disappointed as the initial move would indicate. Of course we can often see a lot of volatility in the immediate aftermath of the data and only once the dust has settled do we see what investors really think of the numbers.

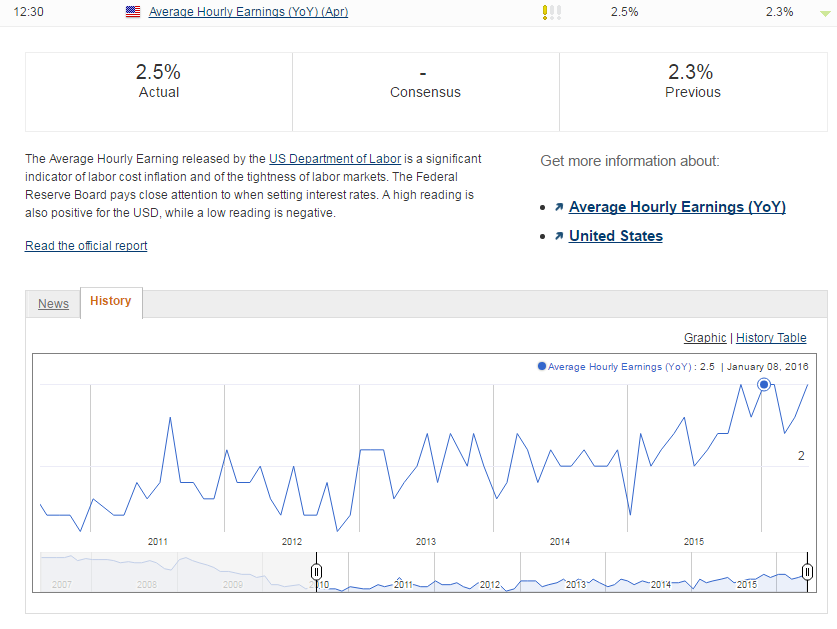

The upside to the report came from average hourly earnings, which I still believe is of high importance to a Federal Reserve that has constantly lauded the performance of the labour market and become frustrated with the lack of wage growth and inflation. Earnings were 2.5% higher compared to April last year, up from 2.3% in March.

While this is still well below what the Fed would like to see, it’s a move in the right direction and as long as this continues, I think they will feel comfortable raising interest rates again. We’ll just have to wait and see whether the June meeting has come too soon. If not, the Fed has a job on its hands convincing the markets because at the moment, investors are far from sold on the idea. And if that remains the case, the Fed will struggle to justify the move given the chaos it could cause.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.