EURUSD tests 100 hour MA and comes off. USDJPY moves to 100 hour MA but rallies back higher

The US employment numbers were a bit of a disappointment. Revisions or lower. Average hourly earnings were 0.0% with the revision to 0.2% from 0.3% last month. The unemployment rate fell to 5.3% from 5.4%. . The underemployment rate fell to 10.5% from 10.7%. The labor participation rate fell to 62.6 which is a low water mark (I think). I would characterize the number as weak-ish, but not that weak. It keeps the Fed hemming and hawing. For traders is makes me want to yell "Poison". In other words.....stay away...choppy waters ahead.

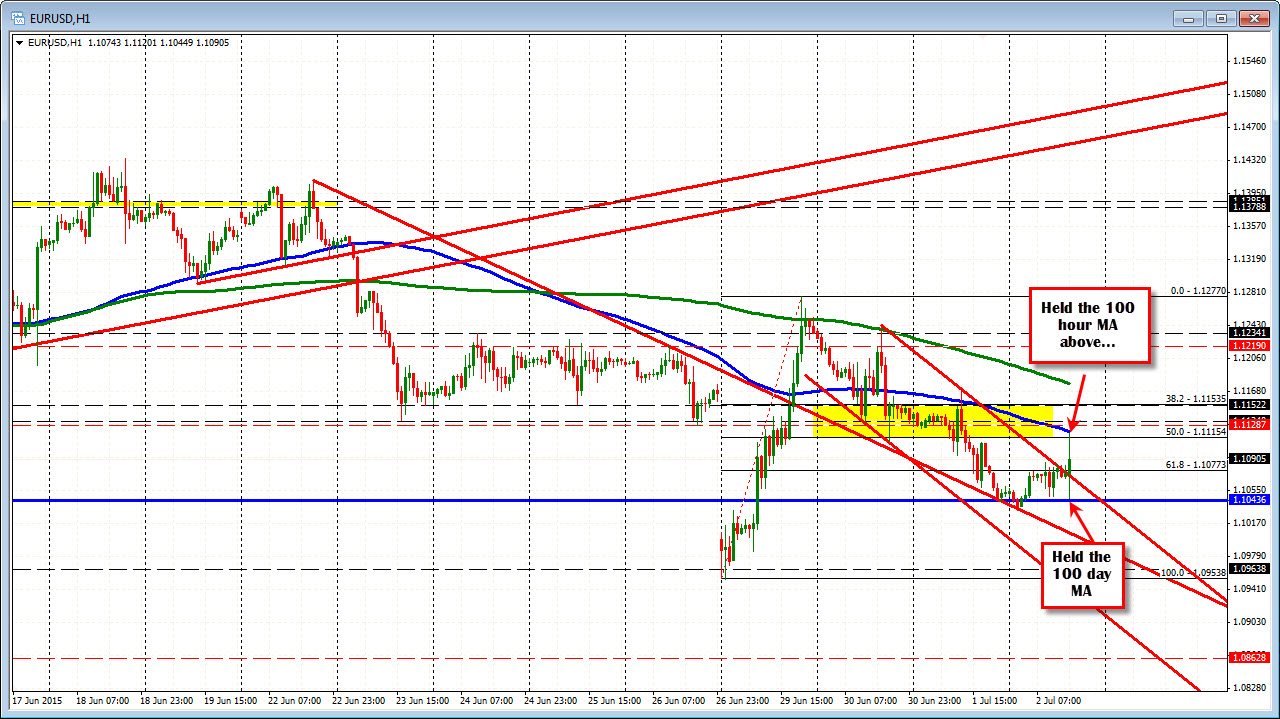

The EURUSD rallied on the news but has found sellers against the 100 hour MA at the 1.1123 area. The 50% of the weeks trading range is at 1.1115 and that too slowed the move higher. The price has moved lower after testing those levels. .

My price chart shows that the 100 DAY moving averages was tested just before the release at the 1.10449 level. So the 100 hour above and 100 day below defines the range. The midpoint of that range is 1.1082. There are a bunch of highs from earlier today in this area so eye this level. A break below really muddies the water. Overall care. Could be a choppy one.

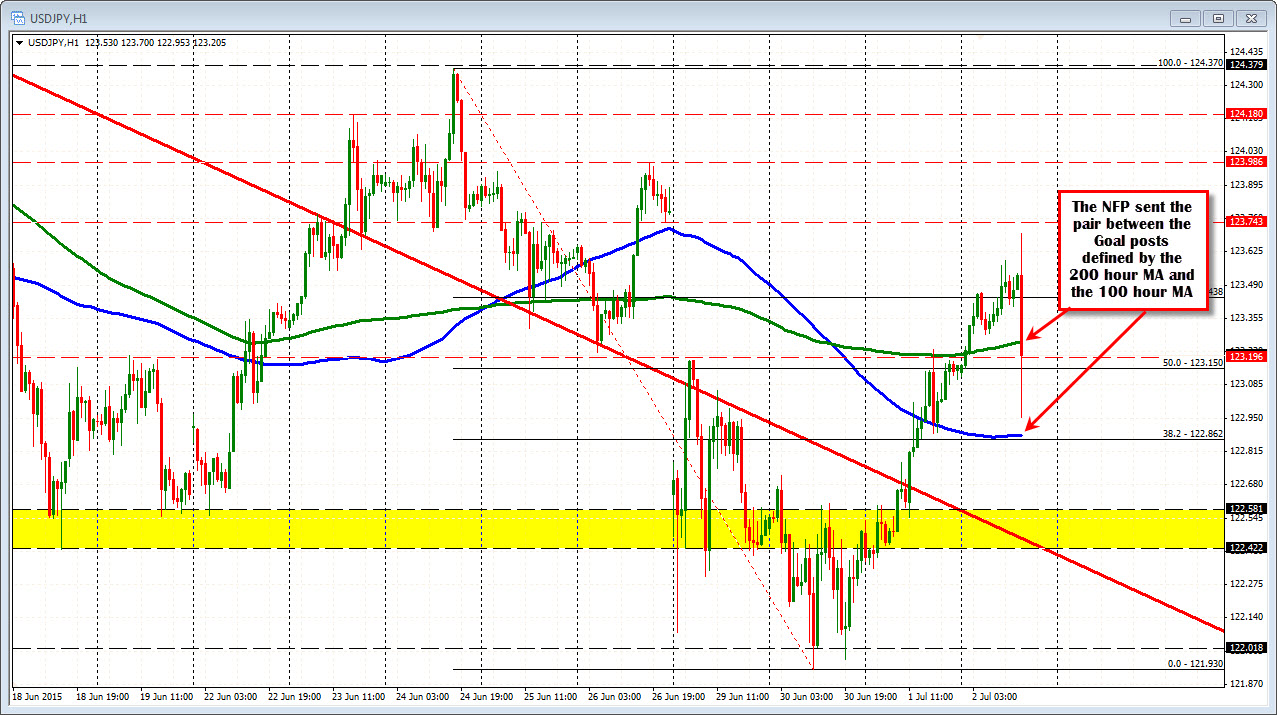

For the USDJPY, the price fell below the 200 hour MA (green line in the chart below)at the 123.25 but could not extend to the lower 100 hour MA (blue line in the chart below)at the 122.88 level. The broken 38.2% of the move down from the June 24 high is also near the 100 hour MA at 1.22862. Traders are trying to keep a lid on the pair against the 200 hour moving average (green line in the chart below). Trading above the 100 hour MA but below the 200 hour MA is a neutral area for me. I call it trading between the Goal Posts. The market can choose to ping pong between the levels until a break higher or lower. HMMM that sounds like a good idea on a Friday...err Thursday before a slipping and sliding Greasy weekend.