Are the USD bulls back in town? The final 24 hours of trading last week certainly gave that impression. While I’m not quite ready to sink into the idea entirely, I am leaning on USD strength as part of my trading plan for the upcoming week.

That said, keep in mind that Monday is a holiday for many countries including the US so volume is expected to be on the lighter side to start the week.

The first pair we’re going to look at is EURUSD. After a four-week rally that lifted the Euro nearly 1,000 pips against the greenback, EURUSD looks ready to continue the downtrend that began one year ago.

Last week the pair failed to break the 1.1452 handle, a level that can be seen influencing price as far back as 1997. After a 380 pip decline between Monday and Wednesday it looked as though the 1.1050 level might attract enough buyers to keep the pair afloat for a bit longer.

But the bears had different plans as they managed to push the market below the key level before the close. This late-week push did more than just break a key level of support. It formed a bearish engulfing pattern with room to run.

From here EURUSD looks ready to revisit the 1.0850 level in the coming week – a price last seen on April 24th. Of course with the banks on holiday on Monday we may not see any significant movement until Tuesday’s session.

Summary: Wait for a retest of the 1.1050 area. Such a retest could present a favorable selling opportunity. Key support comes in at 1.0850, 1.0658 and 1.0470.

Next up is perhaps my favorite potential setup for the new week. After gaining more than 1,200 pips between April 13th and May 14th, GBPUSD appears to be in the process of carving out a top.

The first four trading sessions of last week had the market believing that the ascending channel (shown below) would continue to hold up. However Friday’s failure to hold channel support will likely have the bears smelling blood in the water.

This channel break has some very clear potential targets that line up perfectly with our Fibonacci levels, which I always love to see. The first support level to keep an eye on can be found at 1.5330. Break that and we could see a push down to 1.5105 and possibly 1.4980 if the bears can really get behind this move.

Summary: Watch for bearish price action on a retest of the area between 1.5520 and 1.5570. Key support comes in at 1.5330, 1.5105 and 1.4980.

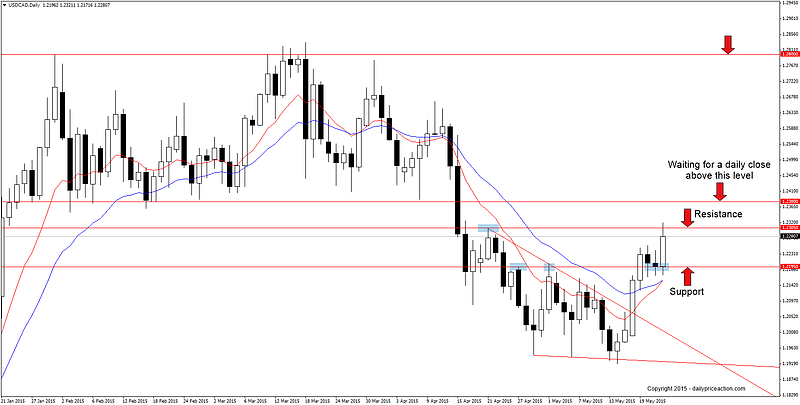

On the back of USD strength we have USDCAD, a pair that finished Friday’s session with a strong push higher. So strong in fact that we have to go back to the last week of January to find a single week’s gains to match last week’s performance.

But as strong as the pair’s performance was last week, there are a few factors that will keep me sidelined, at least in the short-term.

The first factor being the 1.2305 resistance level. While not a level with a long history of influence, it does represent the week high from April 19th. It can also be seen rejecting the bullish advance during last Friday’s session.

The second and more influential level keeping me on the sidelines is the 1.2380 handle. This was the former range low for the pair between the months of January and April. It also represents the 50% retracement from the March highs to the May lows.

The third and final factor is another pair entirely in CADJPY. The pair has been moving within an ascending channel since early February and has recently found significant demand at the 98.64 handle since closing above it on April 28th.

For those who follow me on Twitter you have undoubtedly seen me mention this pair (and level) extensively over the past week. A quick glance at the Forex correlation table tells us that these two are heavily weighted against each other. Therefore I’d like to see the 98.64 level fall on CADJPY before considering a USDCAD long position.

Summary: Waiting for CADJPY weakness below 98.64 and USDCAD strength above 1.2380 before further consideration.

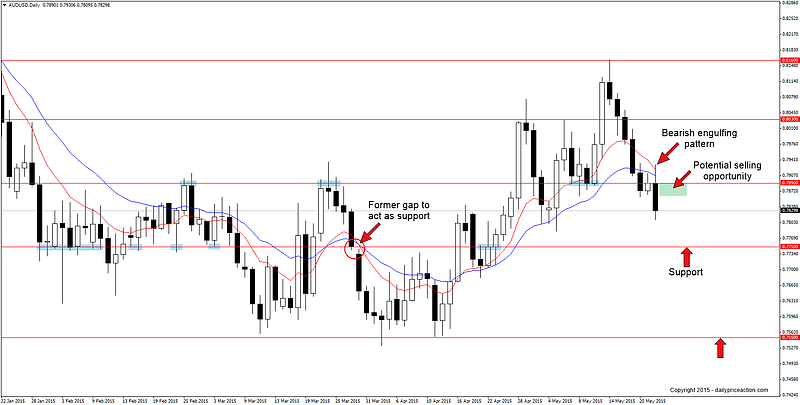

AUDUSD has carved out a pattern very similar to that of EURUSD. After rallying 600 pips against the USD since April 14th and subsequently failing to hold the .8030 level last week, the Australian dollar looks ready to test lower levels in the coming sessions.

On the heels of a bearish inside bar during Thursday’s session the pair finished off the week with a bearish engulfing pattern that broke key support at .7890. I’m favoring downside targets as long as we remain below this level on a daily basis.

Summary: Watch for selling opportunities on a retest of the area between .7860 and .7890 as new resistance. Key support comes in at .7750 and of course the 2015 lows at .7550.

Last but not least is EURAUD. I felt compelled to include the pair given how precise this wedge pattern has been since it began forming in late April.

The pair came into wedge support at the start of last week, however a late Friday push saw prices fall below this level on the 4 hour chart. However I’d like to see a more convincing break to the downside before considering a short entry.

Alternatively, should the pair bounce back this week we could see another retest of wedge resistance. As mentioned previously, I’m bearish on both currencies therefore the deciding factor as to the future direction for the pair will come down to which is least weak.

Although this pattern may produce a favorable setup, I have to favor trading the USD against both the Euro and Australian dollar. Hence I would rather trade either the EURUSD or AUDUSD given the right opportunity.

Summary: Wait for a 4 hour close beyond wedge support or resistance and then watch for a retest of the broken level. Support comes in at 1.3970, 1.3890, 1.3780 and 1.3680 while resistance can be found at 1.4350 and 1.4440