Get Ed Crooks' Energy Pulse in your inbox every week

The US puts up the barriers to Chinese products

EVs, solar modules and batteries are among the imports targeted by steep new tariffs

10 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Breaking down the barriers to grid innovation

-

Opinion

There’s no transition without transmission. How can we make it easier to build?

-

Opinion

Battery storage begins to play a key role for US grids

-

Opinion

The US puts up the barriers to Chinese products

-

Opinion

Google’s demanding goals for decarbonisation

-

Opinion

Reducing the emissions from natural gas

The Roman Emperor Caligula is said to have arrayed his army to fight the English Channel, and then declared victory over the sea. One explanation for this puzzling event is that he was simply insane. Another is that he understood the value of a successful campaign for a leader’s prestige, and in the absence of any genuine military achievements he decided to invent one. It is a trick that remains effective today.

A series of steep tariff increases was announced by President Joe Biden last week, targeting imports of strategically significant products from China. The White House said the tariffs, including new rates of 100% on electric vehicles, 50% on solar cells and 25% on lithium-ion batteries, were intended to “protect America’s workers and businesses from China’s unfair trade practices”.

It would be easy to write off these new tariffs as an attack on an imaginary enemy. Their practical impact will be small. US imports of EVs, solar cells and steel from China are negligible, and were not set to become significant any time soon. President Biden’s goals were political, aimed at bolstering support in November’s elections, rather than warding off any genuine imminent threat.

In symbolic terms, however, the tariff announcement was highly significant. It was a further escalation of growing tensions between the US and China over trade and over low-carbon energy technologies, in particular.

With former President Donald Trump similarly committed to economic nationalism, that strategy is unlikely to change, whatever the result of the election. The US is set on a course of greater protectionism, which will have far-reaching consequences for the energy transition.

Announcing the new tariffs, President Biden said China had heavily subsidised “the industries of the future” – including EVs, solar power and semiconductors – and the excess production was being dumped onto world markets at unfairly low prices, driving rival manufacturers out of business.

“It’s not competition. It’s cheating,” he said. “I want fair competition with China, not conflict.”

China’s government has identified the “new three” sectors – EVs, solar power and lithium-ion batteries – as crucial for its export growth. Huge increases in manufacturing capacity in those sectors have sent prices tumbling, and China’s exports have indeed been rising strongly.

The direct impact on the US, however, has so far been small. In battery electric vehicles, imports from China took only about 1% of the US market last year. Max Reid and Prateek Biswas, Wood Mackenzie EV analysts, say imports of Chinese vehicles into the US have been discouraged by the existing tariffs, which already totalled 27.5%, and by the US’ stringent crash safety standards.

Chinese companies also generally have little brand awareness in the US so would have to work hard to make their vehicles appealing to American consumers. That brand appeal is not an issue for fleet buyers, and Chinese companies have had significant success in targeting that market segment in Europe. Imports from China could take 25% of the European EV market this year. The European Commission has been investigating, and is expected to introduce new tariffs before July of up to 30% on Chinese EV imports into the EU.

In solar cells, imports from China have an even smaller toehold in the US market. Elissa Pierce, a Wood Mackenzie research associate who covers solar supply chains, says that last year just 0.03% of US solar cell imports and 0.09% of module imports came from China. As with EVs, the trade barriers, which include anti-dumping and countervailing duties, were already high enough to keep Chinese exports out of the US market.

A much more important issue for solar supply chains is the Biden administration’s decision to launch an investigation into imports of cells and modules from Cambodia, Malaysia, Thailand and Vietnam, countries that are significant exporters to the US. The Department of Commerce said last week it would investigate claims that those countries are selling solar equipment at less than fair value in the US, creating or threatening to create “material injury” to the domestic cell industry.

The investigation, which covers roughly 80% of all the solar cells and modules imported into the US last year, could result in new antidumping and countervailing duties being imposed. The duties could make exports from those four countries uneconomic and put upward pressure on the price of solar equipment in the US.

Batteries are the one sector where Chinese imports into the US are currently significant. China accounted for about 70% of US imports of lithium-ion batteries last year. About 83% of those Chinese imports went for non-EV uses, mostly for stationary storage. But the impact of the new tariffs is being cushioned by a two-year delay: the new 25% rate will take effect only in 2026 for batteries not used in EVs.

Battery prices are falling, but the new tariffs will slow that decline in the US. Before President Biden’s announcement, Wood Mackenzie was forecasting that total system prices for stationary storage installations in the US would drop about 20% from 2023 levels by 2026. Now we project that decline to be about 15%.

A surge in US battery manufacturing capacity is already underway, thanks to the provisions of the Inflation Reduction Act. The increased tariff will reinforce the price advantage for US producers.

Overall, although the new tariffs will have some impact at the margin, they will not make an enormous difference to the US economy. Their real significance is in what they indicate about US energy and climate policy. President Biden has made it clear that his highest priority is reviving US manufacturing, not cutting emissions at the lowest possible short-term cost.

Wood Mackenzie’s Rory McCarthy has calculated that globally, the cost of reaching net zero emissions in the power sector would be about US$6 trillion (or 20%) higher if no Chinese products were used. President Biden is attempting to achieve that in the US, pursuing a higher-cost strategy with as little reliance as possible on supply chains that begin in or include China.

If former President Trump wins a second term, he might take even stronger measures against imports from China. Increased tariffs are one of the key issues he has championed on the campaign trail, and he has pledged to stop Chinese carmakers with operations in Mexico selling vehicles in the US, should they ever attempt to do so. He has suggested he would welcome Chinese companies investing in the US to manufacture there, but those remarks have not yet been put to the test. Other Republican politicians have opposed Chinese investment.

President Biden is trying to use industrial policy to bring climate, economic and national security goals into alignment. A future Republican administration would deprioritise climate, but the goals of strengthening national security and reviving US manufacturing would remain. For the foreseeable future, the barriers keeping the lowest-cost low-carbon products out of the US are set to remain in place. For the period of the next administration, at least, those barriers are more likely to rise further than they are to fall.

FERC proposes new rules to facilitate grid build-out

The transition of the US electricity system from coal and gas to wind and solar power demands a rapid build-out of the grid, at a pace that is significantly higher than has been achieved for many years. Administrative and regulatory delays are making that build-out more difficult, and over the past couple of years, there has been a sustained effort to clear away some of those barriers.

The Federal Energy Regulatory Commission last week published a landmark new rule on transmission and cost allocation, Order No.1920, which is being described as the most significant initiative in this area for more than a decade.

Its objective is to require US transmission operators to plan for the future needs of the grid, and to work with states to agree how the costs of investment in new capacity should be paid for. FERC said it would “ensure the transmission grid can meet the nation’s growing demand for reliable electricity”.

Transmission operators will be required to produce regional plans, looking at least 20 years into the future, and to update these plans at least once every five years. They will also be asked to “consider” the use of grid-enhancing technologies such as dynamic line rating and advanced power flow control devices.

States will retain key roles in process planning, selecting and determining how to pay for new transmission lines, subject to the requirement that the cost should fall on the customers benefitting from the investment.

The vote on the commission was split on partisan lines. Willie Phillips, the chairman who was appointed by President Biden, and Allison Clements, a Democrat appointed by former President Trump, voted for the order. Mark Christie, a Republican also appointed by former President Trump, voted against it.

In his 30,000-word dissenting statement, Christie argued that the order was intended not to help consumers but “to serve a major policy agenda never passed by Congress,” to boost the profits of “politically preferred generation, primarily wind and solar,” and to support corporate purchasing of low-carbon energy.

Phillips and Clements rejected that argument in a joint statement, saying that states’ attempts to shape the resource mix – such as by supporting renewables – were one factor that transmission planners would be required to take into account. But the fundamental considerations of economics and reliability would “play a much bigger role”.

External reactions to the order were similarly mixed. ITC, the largest independent electricity transmission company in the US, applauded the order. The Cato Institute, a free-market thinktank, described it as “a costly shell game”, unlawfully supporting the Democrats’ climate goals.

Christie in his dissenting statement also argued that the order exceeded FERC’s legal authority. The rules will likely end up in court, with the Supreme Court potentially having the final say.

In brief

Thousands of residents of Fort McMurray, the hub of Canada’s oil sands industry in Alberta, were allowed to return home at the weekend, after being forced to evacuate by wildfires in the region. Rainfall on Wednesday night and into Thursday helped stall the progress of the fire, which had come within about three miles of a landfill on the southern edge of the city.

The newly formed government in the Netherlands, a coalition including the populist PVV party, plans to roll back some of the country’s climate policies while maintaining its overall emissions goals. The mandated installation of heat pumps in new buildings will be abandoned, and net metering for distributed solar will be phased out from the start of 2027. The new government also aims to boost natural gas production and step up investment in new nuclear power plants.

Other views

Hitting the brakes: How the energy transition could decelerate in the US – David Brown

BHP eyes Anglo American for copper growth – James Whiteside

Which global steam crackers are at most risk of closure? – Kelly Cui and others

Bans on electric cars and solar panels? It’s not so implausible – David Fickling

Zombie coal plants could threaten the US energy transition – Jeff St. John

Quote of the week

“We are going to make sure that that [offshore wind] ends on day one… I’m going to write it out in an executive order. It’s going to end on day one.”

Former President Donald Trump, who is currently leading in the polls for November’s presidential election, pledged to end offshore wind development in the US as one of his first acts in office. Trump is a long-standing critic of wind power, claiming that is unsightly, expensive and harmful for birds and whales.

Chart of the week

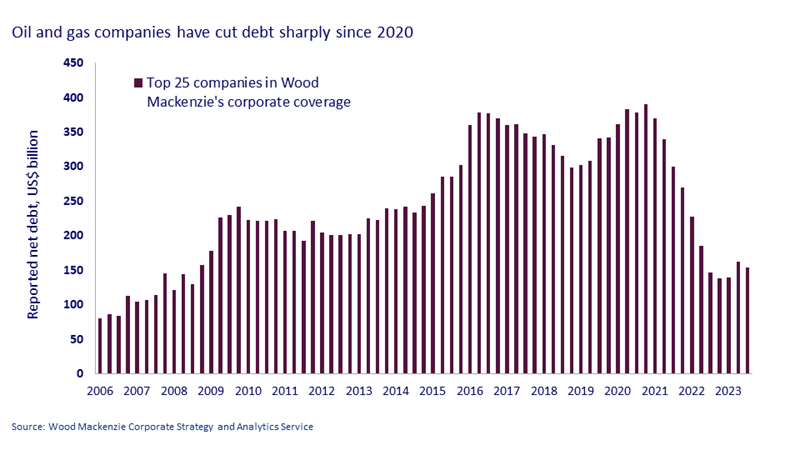

This is another chart from our excellent recent Horizons report ‘Conflicts of interest: the cost of investing in the energy transition in a high interest-rate era’. In Energy Pulse a month ago, I used a different chart from the same report, showing comparisons of the impact of rising interest rates on the levelised cost of electricity from a range of generation technologies.

This time, the chart highlights the position of another energy sector: oil and gas. Since the pandemic, the world’s leading oil and gas companies have worked to reduce their debt burdens, helped by relatively high commodity prices. Today, their debts in absolute terms are back to levels last seen in 2009, and less than half their recent peak in 2020.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.